Private Equity at an Inflection Point: Goldman Sachs

After a sluggish year for dealmaking in 2023, the private equity industry is poised for a turnaround, according to a recent report from Goldman Sachs.

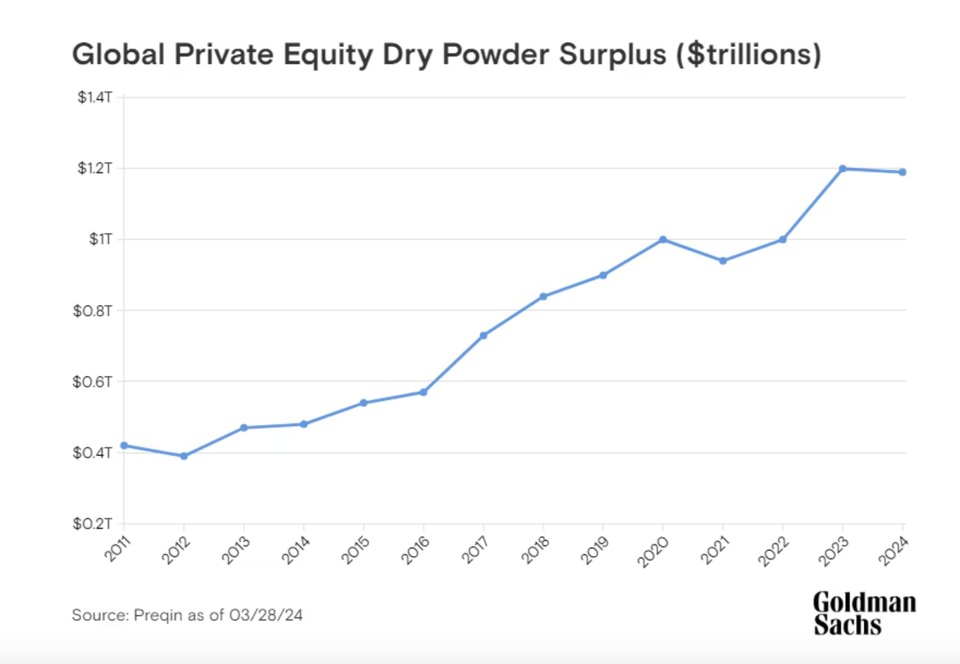

Key factors driving this expected resurgence include stabilizing interest rates, strong company balance sheets, and a substantial pool of "dry powder" - capital raised but not yet invested. Industry data estimates that alternative asset dry powder currently stands at $3.9 trillion, with private equity and private credit accounting for $1.2 trillion and $443 billion, respectively.

This pent-up demand is already translating into increased dealmaking activity. M&A volumes surged by 34% year-on-year in the first quarter of 2024, driven in part by private equity firms' desire to monetize their portfolios and return capital to investors. The approach of the US presidential election is also fueling a sense of urgency among private equity firms seeking to complete deals before potential policy changes.

The rebound in M&A activity is likely to incorporate some of the innovative deal structures and financing solutions that emerged during the 2022-2023 slowdown. "We saw a series of interesting sponsor M&A transactions including public-to-private, sponsor-to-sponsor, and strategic acquisitions of portfolio companies," notes Rob Pulford, Head of Americas Financial and Strategic Investors Group at Goldman Sachs.

Meanwhile, the Goldman Sachs IPO Issuance Barometer, which tracks the macro environment for new IPOs, reached its highest level since February 2022 in March. This indicates that the momentum for initial public offerings is expected to continue, despite ongoing global uncertainties.

The report suggests that the private equity industry is at an inflection point, with a confluence of factors creating a favorable environment for dealmaking and capital raising.