S&P 500 Companies Exceed Earnings Expectations in Q1: FactSet

S&P 500 companies are surpassing earnings expectations for the first quarter of 2024, with both the percentage of companies reporting positive surprises and the magnitude of those surprises exceeding historical averages, according to a report by FactSet.

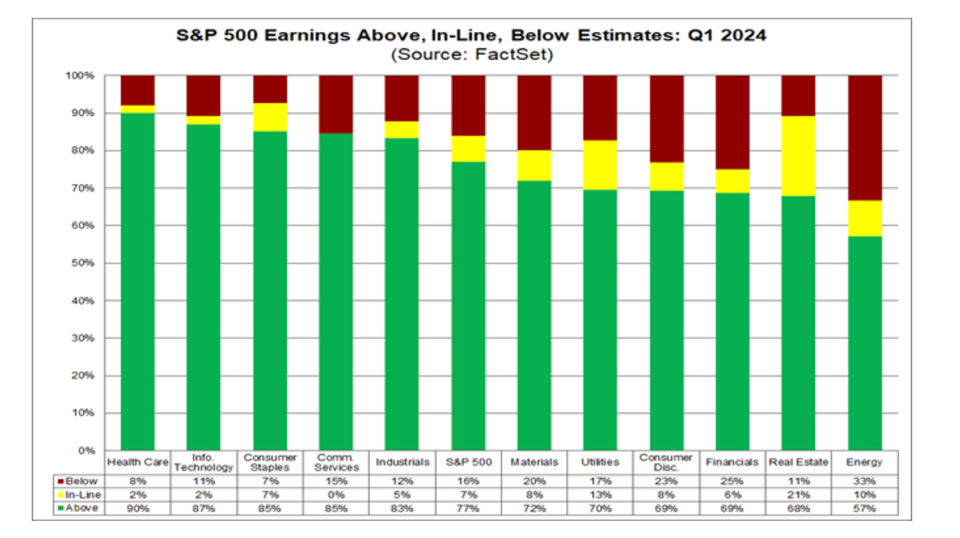

With 80% of S&P 500 companies having reported Q1 results, 77% have exceeded earnings per share (EPS) estimates, matching the five-year average and surpassing the 10-year average. In aggregate, companies are reporting earnings that are 7.5% above estimates, outperforming the 10-year average.

The report highlights the contribution of positive earnings surprises from various sectors, particularly Health Care and Consumer Discretionary, to the overall earnings growth rate for the index. As a result, the blended earnings growth rate for Q1 currently stands at 5.0%, marking the highest year-over-year growth since Q2 2022.

Eight of the eleven S&P 500 sectors are reporting year-over-year earnings growth, led by Communication Services, Utilities, Consumer Discretionary, and Information Technology. However, the Energy, Health Care, and Materials sectors are experiencing year-over-year declines in earnings.

On the revenue front, 61% of companies have reported actual revenues above estimates, although this figure falls below both the five-year and 10-year averages. The blended revenue growth rate for Q1 is currently at 4.1%, marking the 14th consecutive quarter of revenue growth for the index.

Looking ahead, analysts anticipate continued earnings growth for the remainder of 2024, with projected growth rates of 9.6%, 8.4%, and 17.1% for Q2, Q3, and Q4, respectively. The forward 12-month P/E ratio for the S&P 500 stands at 19.9, above both the five-year and ten-year averages.

"At this stage of the Q1 earnings season, S&P 500 companies continue to perform well compared to expectations," says FactSet. "Both the percentage of S&P 500 companies reporting positive earnings surprises and the magnitude of earnings surprises are above their 10-year averages."