Global House Price Declines Moderate Further in Q4 2023, BIS Reports

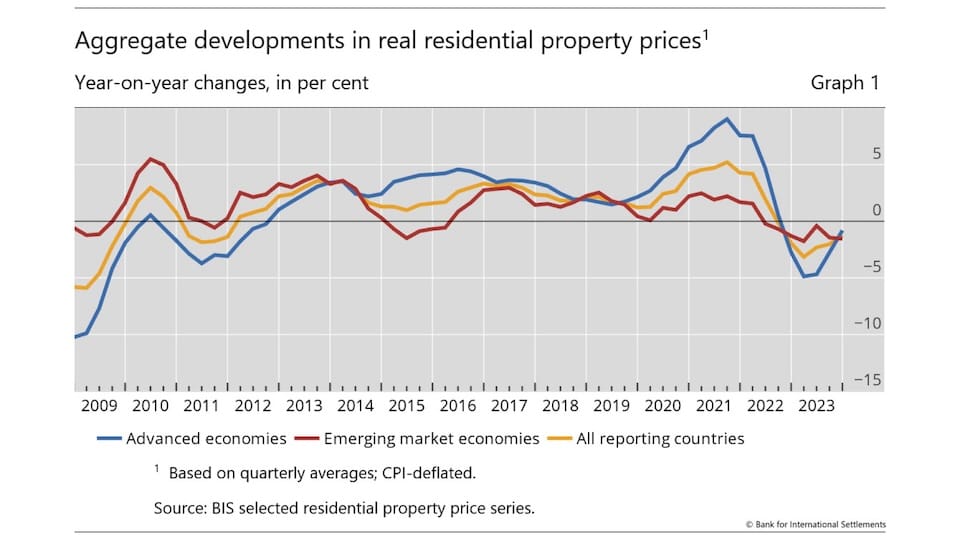

Global house prices continued their downward trajectory in the fourth quarter of 2023, though at a more moderate pace, falling by 1.2% year-on-year (yoy) in aggregate and in real terms, according to the latest statistics released by the Bank for International Settlements (BIS).

The recent decline in global house prices was triggered by a combination of factors:

- Rising interest rates: Central banks around the world began aggressively raising interest rates in 2022 in response to surging inflation. This made mortgages more expensive, dampening demand and putting downward pressure on prices.

- Increased affordability concerns: The rapid price increases during the pandemic, coupled with rising interest rates, led to growing affordability concerns for many potential homebuyers, further reducing demand.

- Economic uncertainty: Global economic uncertainty, stemming from geopolitics, persistent inflation, and the potential for recession, also weighed on housing market confidence and fueled a shift towards more cautious spending.

The report highlights a notable divergence in price trends between advanced economies (AEs) and emerging market economies (EMEs). Real house prices declined more sharply in EMEs (-1.6% yoy) than in AEs (-0.8% yoy) for the first time since late 2022. This shift was driven by a steeper decline in Asia (-2.7%), while central and eastern Europe, Latin America, and the Middle East and Africa regions experienced moderate price increases.

Looking at individual countries, approximately 60% of jurisdictions in both AE and EME groups witnessed a decrease in real house prices in Q4 2023. However, unlike previous quarters, only two economies experienced double-digit price falls. Real prices declined most sharply in Luxembourg (-17%) and Germany (-10%), with Hong Kong SAR and Korea closely trailing at around -10%.

Despite the general downward trend, several countries continue to exhibit robust housing markets. Real house prices grew by at least 5% in four jurisdictions in EMEs and three in AEs. The most significant price increases occurred in the United Arab Emirates (+15%), Greece and Türkiye (both +8%), and Poland (+7%).

Global house prices still remain significantly above their average levels observed after the 2007-09 Great Financial Crisis.

"From a longer-term perspective, global house prices exceed (in real terms) their immediate post-GFC average by 23% (32% for AEs and 16% for EMEs)," states BIS.