API Reports Rise in US Crude Oil Production Despite Overall Petroleum Demand Dip

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

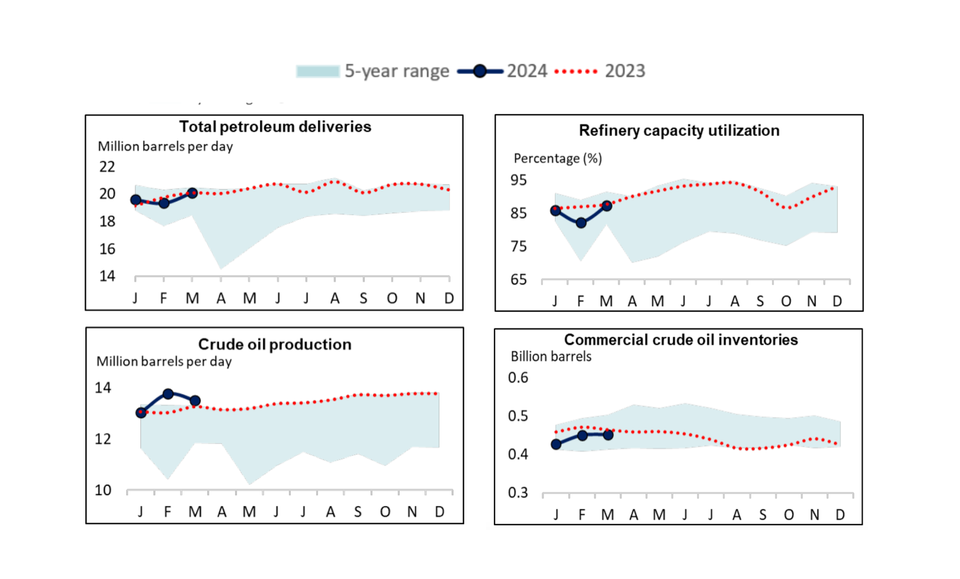

The American Petroleum Institute (API) reported a slight year-over-year increase in US crude oil production for March 2024, reaching 13.0 million barrels per day (mb/d). This represents a 1.9% increase compared to March 2023 and contributes to the overall stability of US domestic petroleum supply.

However, the report also highlights a slight decline in total US petroleum demand, down 0.1% year-over-year to 20.1 mb/d. This decrease is primarily attributed to lower demand for motor gasoline and distillates, which fell by 1.8% and 10.3% respectively compared to March 2023. These declines were partially offset by increased demand for kerosene-type jet fuel, residual fuel oil, and other oils used in refining and petrochemical production.

Despite the dip in overall petroleum demand, US refining activity saw a slight uptick in March, with throughput increasing by 0.1% year-over-year to 16.0 mb/d. This reflects a capacity utilization rate of 87.3%, indicating a relatively healthy level of activity within the refining sector.

The API report also notes an increase in petroleum prices during March. West Texas Intermediate (WTI) crude oil prices averaged $81.28 per barrel, marking a 10.9% year-over-year increase. Brent crude oil prices also saw a rise, averaging $85.41 per barrel, up 8.9% compared to March 2023.

While US petroleum exports and imports both declined in March, the US maintained its status as a net exporter for the 30th consecutive month. Net exports reached nearly 2.3 mb/d, the third-largest level on record.

US crude oil inventories saw a slight month-over-month increase in March, reaching 452.4 million barrels. However, this still represents a 2.8% decrease compared to March 2023.