Eurodollar: A Primer

The Eurodollar market, a cornerstone of global finance, often remains shrouded in mystery. What exactly are Eurodollars? Who participates in this market and why? How do Eurodollars influence international trade? This article delves into these questions, shedding light on the inner workings of this crucial financial instrument.

What is a Eurodollar?

Contrary to what the name might suggest, a Eurodollar has nothing to do with the European Union's currency, the euro. Instead, a Eurodollar is simply a U.S. dollar-denominated deposit held in a bank outside of the United States. This can include banks located in Europe, Asia, or any other part of the world. The term "Eurodollar" originated in the 1950s when the Soviet Union, holding large amounts of US dollars, deposited them in European banks to avoid potential US government interference.

The Eurodollar market operates independently of the Federal Reserve, making it a significant player in the global financial system. It provides a vast pool of liquidity, allowing international businesses and financial institutions to borrow and lend US dollars without being subject to US banking regulations.

Who Borrows and Lends in the Eurodollar Market?

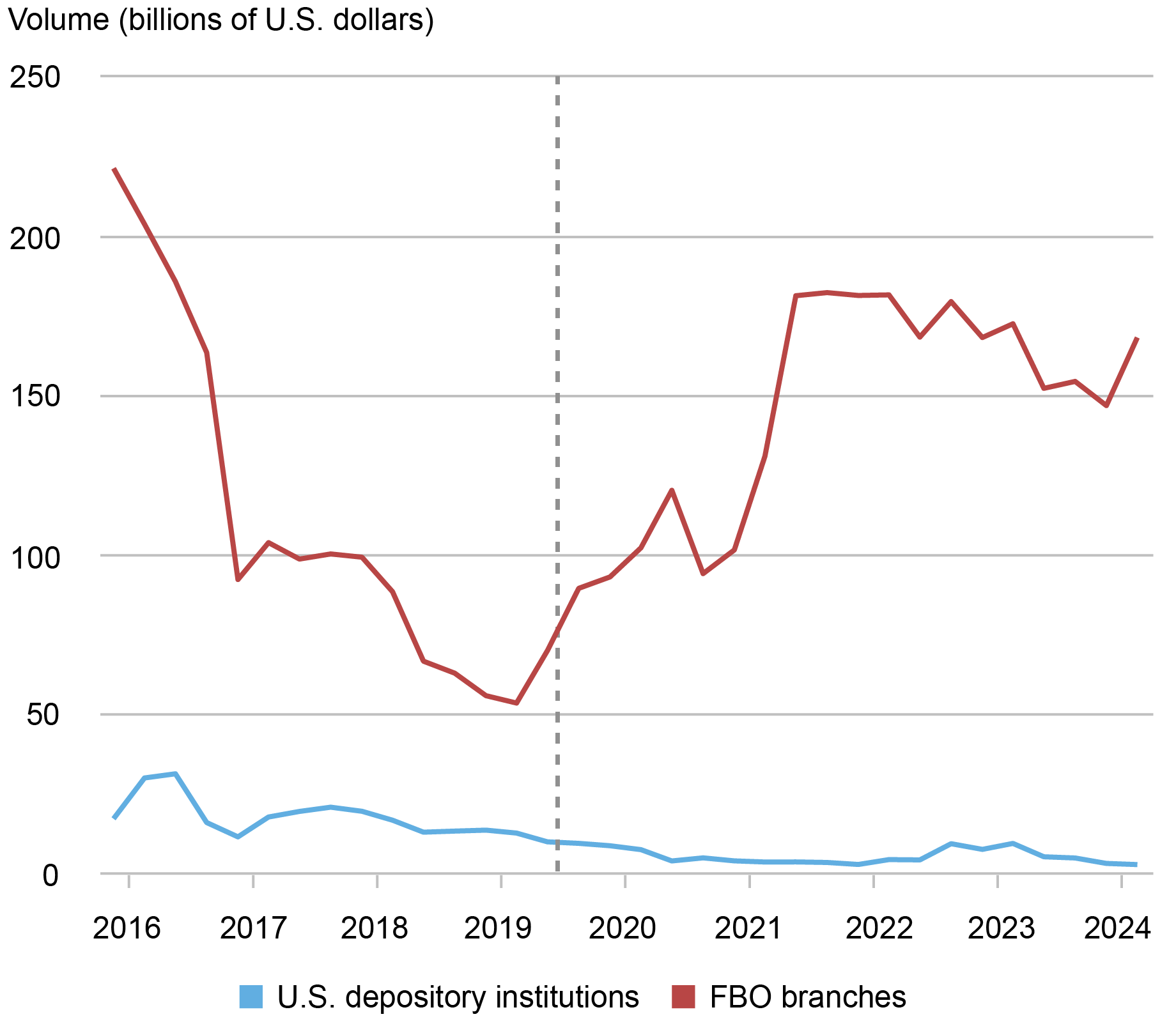

According to research conducted by the New York Fed, a clear pattern emerges regarding the participants in the Eurodollar market. On the borrowing side, U.S. branches and agencies of foreign banks (FBO branches) dominate, accounting for over 90% of the daily volume (see Chart 1). Why are these FBO branches so reliant on Eurodollar borrowing? A key reason lies in the fact that deposits at FBO branches, with a few exceptions, are not insured by the Federal Deposit Insurance Corporation (FDIC). This lack of FDIC insurance restricts FBO branches from accepting retail deposits, making them highly dependent on wholesale funding sources like the Eurodollar market. Additionally, because they don't bear the cost of FDIC insurance, FBO branches enjoy a lower effective cost of borrowing, giving them a competitive edge in the Eurodollar market.

Chart 1: FBO Branches Are the Main Borrowers of Eurodollars and Selected Deposits

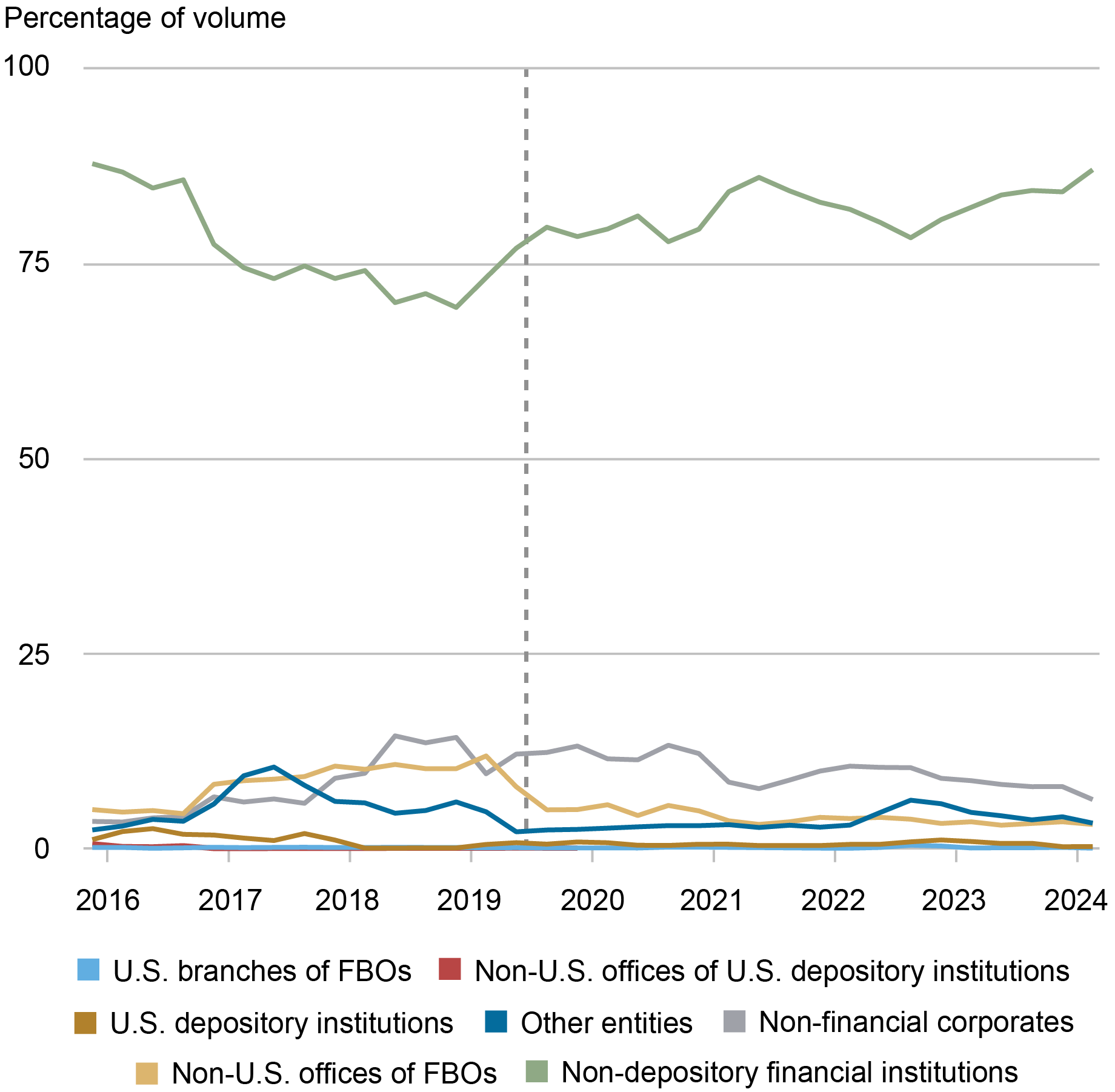

Turning to the lending side, non-depository institutions, primarily financial intermediaries like brokerage firms, underwriters, credit originators, insurance companies, and pension funds, play a significant role. These institutions account for around 80% of the lending volume in the overnight Eurodollar market.

Non-depository Financial Institutions Are the Main Lenders of Eurodollars and Selected Deposits

The composition of lenders in the Eurodollar market contrasts sharply with the Federal Funds market, where Federal Home Loan Banks (FHLBs) dominate. Interestingly, borrowing from FHLBs offers banks a regulatory advantage in calculating their Liquidity Coverage Ratio (LCR), making the Federal Funds market more appealing than the Eurodollar market for some institutions, despite potentially higher interest rates.

How are Eurodollars Used in International Trade?

Eurodollars play a critical role in facilitating international trade by providing a convenient and accessible source of US dollar funding. Businesses engaged in cross-border transactions often face challenges in obtaining financing in their local currency. The Eurodollar market addresses this issue by offering a readily available pool of US dollars, the most widely used currency in international trade.

For example, a European importer purchasing goods from a US company might use Eurodollars to settle the transaction without needing to convert Euros to US dollars, saving on conversion costs and streamlining the payment process. Conversely, a US exporter might receive payment in Eurodollars, which can then be used to finance operations in other countries or invested in US dollar-denominated assets.

The vast scale and liquidity of the Eurodollar market ensure a relatively stable exchange rate for US dollars, making it a reliable medium of exchange for international trade. This stability reduces uncertainty and risk for businesses, fostering greater confidence in cross-border transactions.

The Impact of Eurodollar Trading on Exchange Rates

Eurodollar trading exerts a significant influence on foreign exchange rates through a complex interplay of factors. Here's how:

- Demand for Currencies: The appetite for Eurodollars among investors and businesses seeking higher returns or US dollar funding directly impacts the demand for the US dollar itself. Increased demand for Eurodollars typically leads to an appreciation of the US dollar against other currencies.

- Interest Rate Differentials: Eurodollar interest rates, shaped by US monetary policy and global liquidity conditions, can diverge significantly from interest rates offered in other currencies. These interest rate differentials incentivize investors to seek higher-yielding currencies, triggering currency flows that influence exchange rates.

- Hedging and Speculation: The robust and liquid Eurodollar futures market provides a platform for traders to speculate on or hedge against future fluctuations in US dollar interest rates and exchange rates. The trading activity within these futures contracts, through signaling effects and positioning adjustments, can exert a palpable influence on spot exchange rates.

- Arbitrage Opportunities: Discrepancies in Eurodollar rates across different markets can create lucrative arbitrage opportunities for savvy investors. The resulting currency flows aimed at exploiting these discrepancies contribute to the dynamism of exchange rate movements.

- Liquidity Conditions: As a primary source of US dollar funding globally, shifts in Eurodollar liquidity conditions impact the availability and cost of US dollar funding. These changes, in turn, influence currency values by altering the dynamics of supply and demand.

Conclusion

The Eurodollar market, though often overlooked, forms a vital component of the global financial system. Its unique characteristics allow international businesses and financial institutions to access US dollar funding, facilitating cross-border trade and investment. By understanding the workings of this market, including its impact on exchange rates, we gain valuable insights into the intricate connections between global finance and international commerce.