Fed Funds Market: A Primer

In this post, we'll look at the Fed Funds market, how it impacts the US economy, and the key players that are driving the Fed Funds market.

What is the Fed Funds Market?

The Fed Funds market is essentially an overnight lending market where banks with excess reserves lend to banks facing shortfalls in their required reserves. These overnight loans of reserve balances are termed "federal funds," and the interest rate charged on these loans is known as the "federal funds rate." Unlike many other lending markets, transactions in the Fed Funds market are unsecured, meaning they are not backed by collateral. This market provides a mechanism for banks to efficiently manage their reserve positions and comply with the reserve requirements set by the Federal Reserve.

How Does the Fed Funds Market Affect the Economy?

The Fed Funds market and the federal funds rate are powerful instruments that significantly impact the US economy through various channels:

- Transmission of Monetary Policy: The Federal Open Market Committee (FOMC) utilizes the target range for the federal funds rate as its primary tool for implementing monetary policy. By adjusting this target rate, the Fed can influence interest rates across the economy, impacting borrowing costs for both businesses and consumers. This, in turn, affects investment, spending, and overall economic activity.

- Impact on Money Supply and Liquidity: Changes in the federal funds rate directly influence the supply of reserves within the banking system. Lower rates tend to increase liquidity and expand the money supply, stimulating economic activity. Conversely, higher rates have a contractionary effect by reducing the money supply, potentially slowing down economic growth.

- Effect on Consumer and Business Spending: The federal funds rate exerts a ripple effect on other key interest rates, such as prime rates, mortgage rates, and corporate borrowing rates. Lower rates make borrowing more affordable, encouraging consumer spending on big-ticket items like homes and vehicles, as well as stimulating business investment and expansion.

- Exchange Rate Effects: Fluctuations in the federal funds rate can influence the attractiveness of US dollar-denominated assets, impacting capital flows and exchange rates. These movements can affect the competitiveness of US exports and the overall trade balance.

- Asset Prices and Wealth Effects: A lower federal funds rate tends to boost asset prices, such as stocks and real estate. This creates a positive wealth effect, leading to increased consumer spending and economic growth. Conversely, higher rates can depress asset values, potentially dampening economic activity.

- Inflation Management: The Fed carefully adjusts the federal funds rate to maintain price stability and control inflation. Higher rates can help cool down an overheating economy and curb inflation, while lower rates can stimulate inflation if it falls too low.

Who are the Borrowers and Lenders in the Fed Funds Market Today?

The landscape of the Fed Funds market has shifted dramatically since the 2008 financial crisis. The Federal Reserve's expansion of its balance sheet, leading to a significant increase in reserves held by banks, and the introduction of interest payments on these reserves have significantly altered the dynamics of this market.

Today, U.S. branches and agencies of foreign banks (FBO branches) are the primary borrowers in the Fed Funds market. Since 2016, FBO branches have borrowed around $45-$110 billion each day, representing between 65%-95% of the daily volume of the Fed Funds traded. These FBO branches rely on this market due to their limited access to FDIC insurance, restricting their ability to attract retail deposits. Additionally, their exemption from FDIC assessment fees gives them a cost advantage in borrowing federal funds.

Chart 1: FBO Branches Are the Main Borrowers in the Fed Funds Market

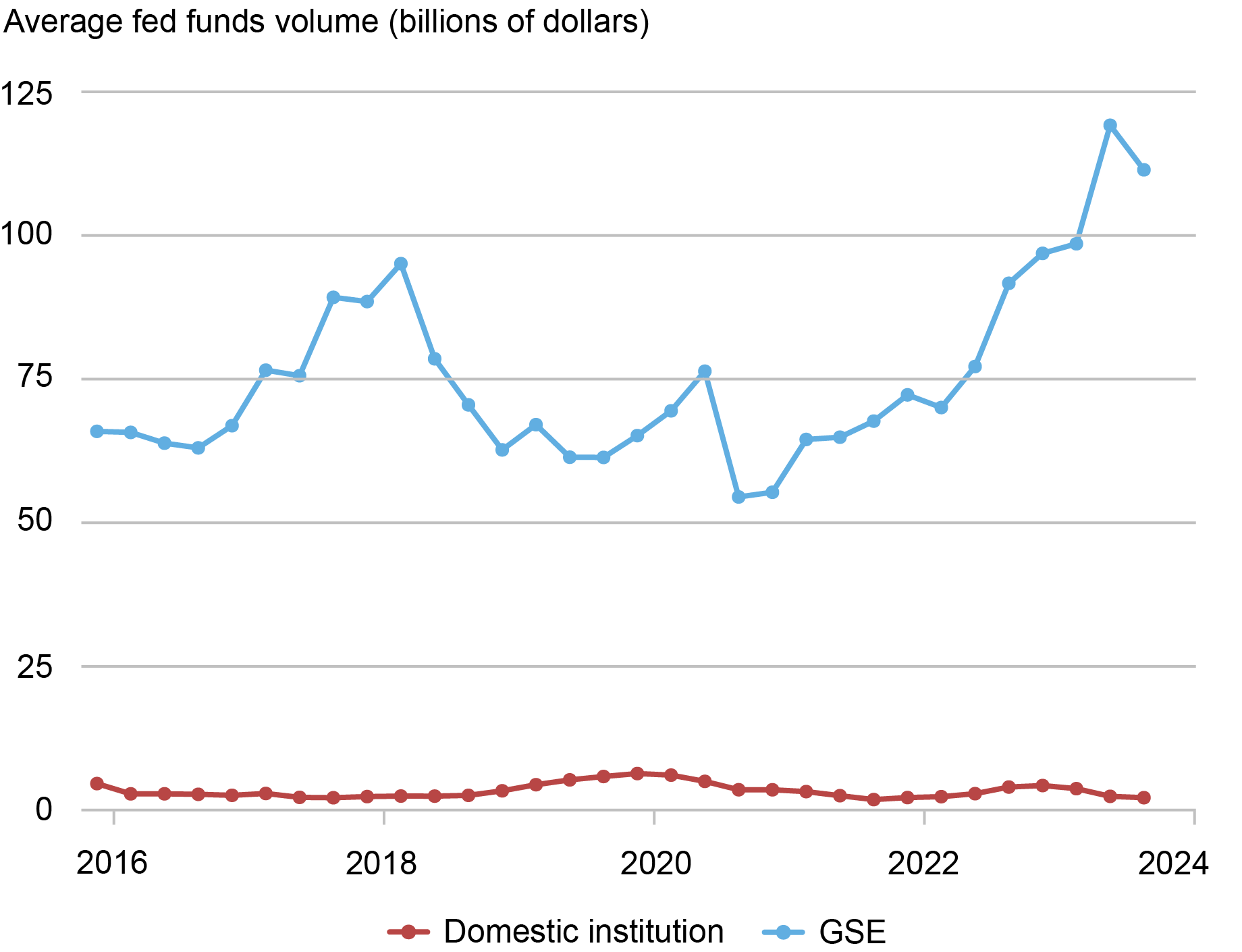

On the lending side, Federal Home Loan Banks (FHLBs) dominate and are responsible for more than 90% of the total daily volume of fed funds traded. These government-sponsored enterprises utilize the Fed Funds market to invest excess cash holdings, and their lack of interest earnings on reserves at the central bank incentivizes them to lend at rates below the interest on reserve balances (IORB) rate.

Chart 2: FHLBs Are the Main Lenders in the Fed Funds Market

Domestic banks, on the other hand, play a relatively smaller role in both borrowing and lending within the Fed Funds market today due to the ample reserves within the system and the ability to earn interest on these reserves.

The Fed Funds Rate and Inflation: A Close Relationship

The Federal Funds rate and inflation share a close and intertwined relationship. The Fed Funds rate is the Federal Reserve's primary tool for managing inflation. By adjusting this rate, the Fed can influence overall interest rates and credit conditions throughout the economy.

Here's how the relationship works:

- Inflation Control: When inflation rises above the Fed's target (currently 2% on average), the central bank typically raises the federal funds rate. Higher interest rates make borrowing more expensive, which helps cool down economic activity and reduce inflationary pressures.

- Stimulating Growth: Conversely, when inflation is too low, the Fed lowers the federal funds rate. Lower rates encourage more borrowing and spending by businesses and consumers, stimulating economic growth and pushing inflation back up towards the target.

- Lag Effect: It's important to note that there is a lag between changes in the federal funds rate and their impact on inflation. It can take 12-24 months for the full effects of a rate change to filter through the economy and impact prices.

Historical data, such as the "Volcker shocks" of the early 1980s, provides clear evidence of this relationship. During this period, exceptionally high interest rates were implemented to combat double-digit inflation, ultimately bringing it under control.

Conclusion

The Fed Funds market is a vital cog in the machinery of the US financial system. It serves as a critical tool for the Federal Reserve to implement monetary policy, manage liquidity, and influence economic conditions, including inflation. By understanding the mechanics of this market, the key players involved, and its impact on the broader economy, we gain a deeper understanding of how monetary policy decisions shape the global macro landscape.