Central Banks Fuel Record-Breaking Gold Demand: World Gold Council

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

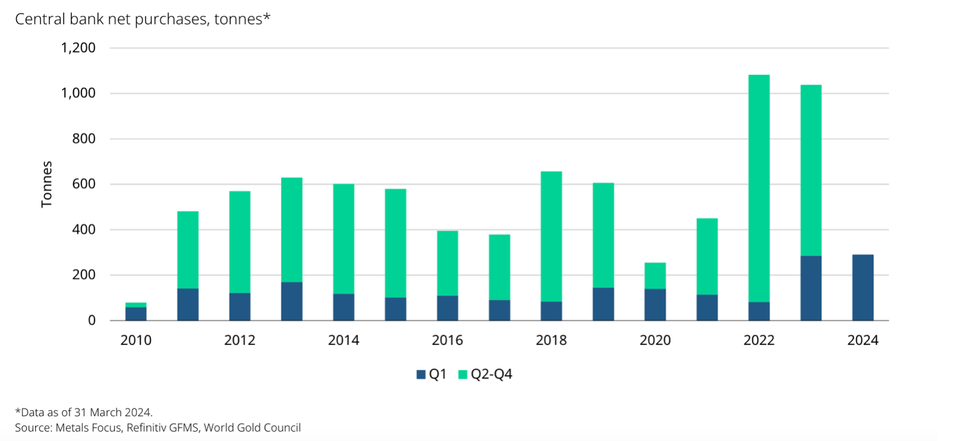

Central banks worldwide continued their strong appetite for gold, setting a new first-quarter record for net purchases, according to the latest report by the World Gold Council. Global official gold reserves grew by a net 228 tonnes in Q1 2024, surpassing the previous Q1 record set in 2013 and marking a 68% increase compared to the five-year quarterly average.

Gold prices have soared in recent months, reaching a series of record highs as investors anticipate a potential decline in US interest rates. Central bank gold purchases, a trend that began in 2022, have further contributed to this upward momentum.

Leading this trend among emerging markets, ten central banks reported increased gold reserves of a tonne or more during the quarter, with Turkey, China and India leading the way.

"The strong start reinforces our view that central bank demand will remain robust in 2024," says the World Gold Council.

Taking the lead in gold acquisitions, the Central Bank of Turkey bolstered its reserves with an additional 30 tonnes of gold during the first quarter, bringing its total holdings to a substantial 570 tonnes. This move marks ten consecutive months of gold purchases, underscoring Turkey's commitment to increasing its gold reserves as a safeguard against economic uncertainties and currency fluctuations.

The People's Bank of China continued its purchase streak, adding 57 tonnes to its gold reserves in Q1 2024, marking the 17th consecutive month of increases. This strategic accumulation has bolstered China's gold holdings to 2,262 tonnes, as the country seeks to reduce reliance on US dollar and diversify its reserves.

The Reserve Bank of India also made substantial gold purchases, adding 19 tonnes to its reserves and exceeding its total net purchases for the entire previous year. Other notable buyers in the region include the National Bank of Kazakhstan, the Monetary Authority of Singapore, and the Central Bank of Oman.

In contrast to the dominant trend of gold accumulation, the report also highlights some selling activity, notably from the Central Bank of Uzbekistan and the Bank of Thailand. However, these instances were primarily driven by portfolio optimization rather than a shift away from gold.