EIA Forecasts Brent Crude to Remain Near $90 per Barrel in 2024

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

The US Energy Information Administration (EIA) projects that Brent crude oil prices will remain near $90 per barrel for the remainder of 2024, supported by voluntary OPEC+ production cuts and ongoing geopolitical risks. However, the EIA anticipates a gradual decline to an average of $85 per barrel in 2025 as global oil production growth picks up.

OPEC+ Cuts and Geopolitical Tensions Tighten Oil Market

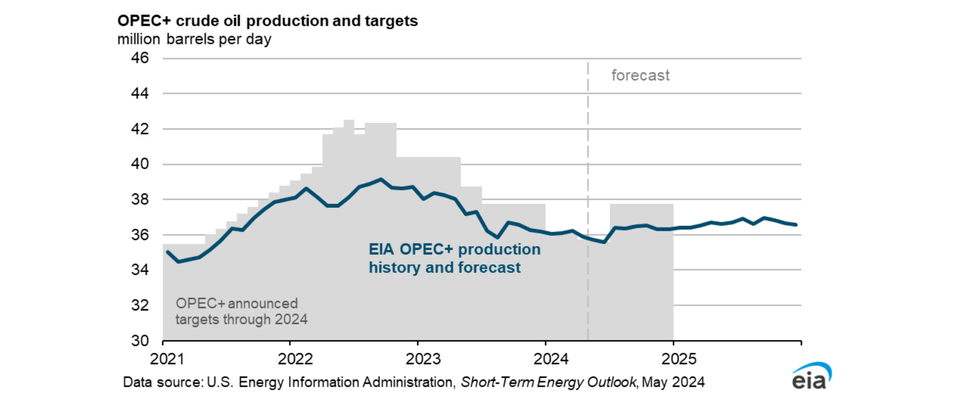

In a report released on Tuesday, EIA highlights the impact of OPEC+ production cuts and geopolitical tensions on the global oil market. The voluntary cuts, which are set to expire at the end of June, have removed approximately 2.2 million barrels per day (b/d) of supply from the market, contributing to a tightening of global oil inventories.

Geopolitical tensions, particularly in the Middle East, have also played a role in supporting oil prices. While significant spare crude oil production capacity, estimated at around 4 million b/d, has helped mitigate price volatility, the EIA points out the potential for increased price fluctuations and sharp increases in the event of further escalation or supply disruptions.

Global Oil Production Growth to Accelerate in 2025

Global oil production growth to expected to accelerate in 2025 as OPEC+ production cuts expire and output from non-OPEC+ countries continues to rise. The agency forecasts an increase of 1.0 million b/d in global petroleum and other liquid fuels production in 2024, followed by a further increase of 1.9 million b/d in 2025.

Growth in 2024 will be primarily driven by non-OPEC+ producers, with the United States, Canada, Brazil, and Guyana leading the way. The EIA expects the startup of the Trans Mountain pipeline expansion in Canada to alleviate distribution bottlenecks and contribute to increased crude oil production.

Inventory Drawdown Driven by Rising Refinery Runs

On the domestic front, the EIA projects a decline in inventories in the coming months followed by a rebound in 2025. US commercial crude oil inventories are anticipated to fall to below 430 million barrels in August, approaching the previous five-year low for that month. This decline is attributed to an expected increase in US refinery runs, which are projected to average 16.2 million barrels per day (b/d) in the third quarter of 2024, up from 15.4 million b/d in the first quarter.

Despite the anticipated growth in US crude oil production, the EIA expects tight global oil markets to absorb the additional supply through exports or displacement of existing imports, preventing a buildup in inventories. However, this trend is expected to reverse in the latter part of 2024 and into 2025.

Inventory Rebound Expected in Late 2024 and 2025

Rising US crude oil production, coupled with decreasing refinery runs and a loosening of global oil market balances, are expected to contribute to an inventory rebound after August 2024. US crude oil production is forecast to reach a record high of 13.7 million b/d in 2025, surpassing the previous record set in 2023. Meanwhile, US refinery runs are expected to decline slightly to an average of 15.8 million b/d in 2025.

Net Crude Oil Imports to Continue Declining Trend

What does this mean for US reliance on imported crude oil? The combination of increasing US crude oil production and decreasing refinery runs is expected to lead to a further decline in net imports of crude oil. This trend aligns with the long-term trajectory of declining US reliance on imported crude oil, facilitated by the growth in domestic production and the lifting of export restrictions in 2015.

The EIA forecasts that US crude oil net imports will fall from 2.4 million b/d in 2023 to 2.1 million b/d in 2024 and further decline to 1.3 million b/d in 2025.

The agency's forecast suggests a relatively balanced oil market in the second half of 2024, with prices remaining near $90 per barrel. However, the outlook remains subject to significant uncertainty, particularly regarding geopolitical developments and the future production strategies of OPEC+ members. As of today, Brent crude (ICE) is trading at $83/bbl.