European Outflows Dominate Global Gold ETF Market in April

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

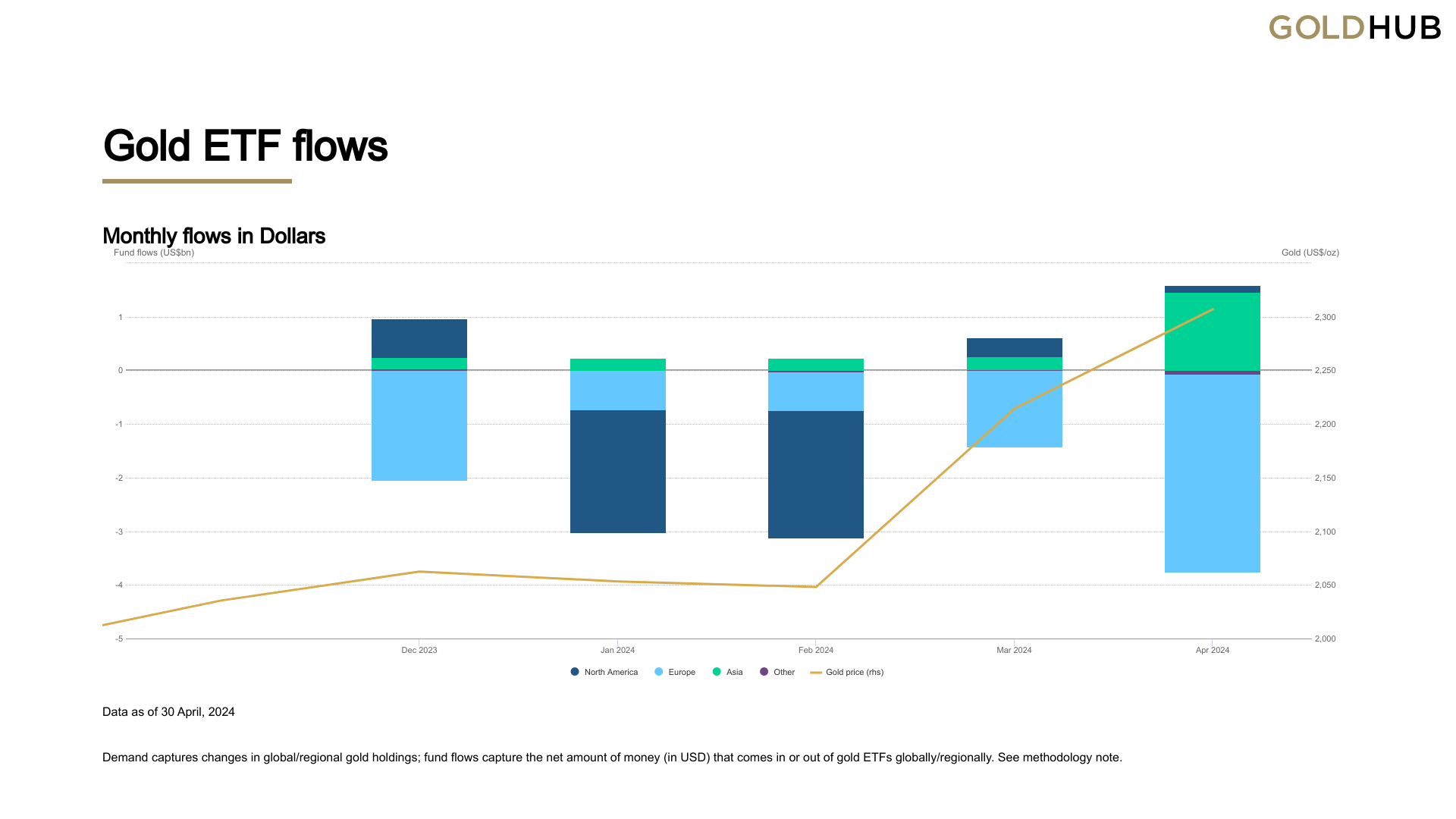

Global gold ETFs saw continued outflows in April, wiping out early gains driven by a strengthening gold price, according to a note published by the World Gold Council (WGC) on Wednesday. While Asian funds led global inflows and North American funds saw modest demand, these were dwarfed by significant outflows from European funds.

By the end of April, global gold ETF holdings had fallen to 3,079 tonnes, their lowest level since February 2020. However, the month's higher gold price lifted total assets under management (AUM) by 3% to US$229 billion.

European funds experienced their eleventh consecutive month of outflows, shedding US$4 billion in April. The WGC attributes this trend to a combination of factors, including rising bond yields, improved economic prospects, and geopolitical uncertainties. "Improved economic prospects and geopolitical uncertainties – which threaten to push up the oil price – as well as recent comments from the US Fed indicating delayed rate cuts, may have been key contributors," the WGC states.

These European outflows countered robust demand in Asia, where funds extended their inflow streak to 14 months with a gain of US$1 billion. China, in particular, witnessed record monthly inflows and reached an all-time high in AUM, fueled by a sluggish equity market, expectations of a weaker yuan, and aggressive promotion by ETF providers.

"April (+US$1bn) extended Asian funds’ inflow streak to 14 months. China was the main engine in the month, where gold ETFs witnessed not only record monthly inflows (+US$1bn) but also reached their highest AUM ever," reports the WGC. "And the growth in assets amounts to a stunning 36% so far in 2024."

Despite the overall outflows, trading volumes in gold ETFs surged across all regions, particularly in North America, indicating continued investor interest. This suggests that the gold market remains dynamic and subject to diverse investor sentiment and regional trends.