Global Economic Expansion Broadens, But US Growth Slows: S&P Global

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

The global economic expansion is becoming increasingly broad-based, with Europe and Japan showing signs of accelerating growth, according to the latest Flash PMI data compiled by S&P Global. However, the US economy appears to be bucking this trend. It is experiencing a slowdown in growth and a decline in employment.

"It is encouraging that all four economies have now reported growth for a second successive month to hint at a broad-based economic expansion," notes Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, in the report. On the other hand, he also points to a slight loss of momentum in the weighted average output index for G4, driven primarily by the slowdown in the US.

Japan and the Eurozone saw particularly strong growth, reaching eight-month and eleven-month highs respectively, indicating progress in overcoming recent economic challenges. In contrast, US growth slowed to a four-month low, despite maintaining a 15-month streak of expansion.

Interestingly, the report highlights a divergence between the manufacturing and services sectors. While US growth slowed across both sectors, Europe, the UK, and Japan witnessed stronger service sector performances that offset downturns in manufacturing.

Looking ahead, the report suggests that further slowdown may occur in May, as the G4 new orders index dipped below the no-change level for the first time since December. Additionally, future output expectations declined to a four-month low.

Employment trends also varied across regions. The G4 as a whole experienced its first month without net job creation since August 2020. However, stronger job gains were observed in the Eurozone, UK, and Japan, while the US suffered a notable drop in employment, marking the first decline since the early months of the pandemic.

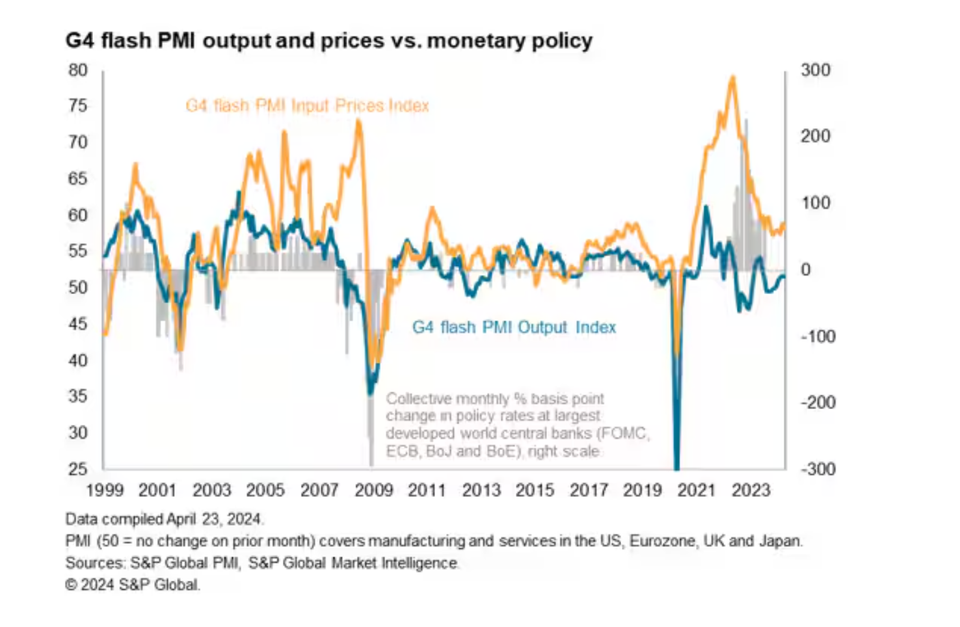

The report also sheds light on the inflation picture, which remains characterized by persistently high service sector inflation rates and signs of reviving price pressures in manufacturing. However, overall selling price inflation rates remain close to central bank targets in the US and Eurozone.

"Comparing these indices with consumer price inflation rates, the PMI data point to inflation running close to central bank 2% targets in the US and eurozone, but exceeding targets in the UK and most notably in Japan," Williamson notes.

The report concludes by highlighting some key factors to monitor in the coming months, including the impact of wage increases in the UK, rising oil prices in the US, and a weaker yen in Japan, which could influence the trajectory of inflation rates.