Goldman Sachs Projects 50% Growth for Global Gas Market

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

The global oil and gas industry is undergoing a major transformation, driven by declining oil demand and rising global demand for natural gas, according to a new note published by Goldman Sachs Research on Thursday. This shift is evident in investment trends, with oil investment showing signs of peaking in non-OPEC countries, while investment in liquefied natural gas (LNG) is projected to soar.

"We are seeing a complete realignment of capital, and this is coming despite a good oil and gas price environment and very healthy returns," says Michele Della Vigna, Head of Natural Resources Research in EMEA at Goldman Sachs Research.

Declining Oil Outlook

Investment in oil projects is shifting towards shorter-cycle, shorter-life projects, such as US shale and some deepwater projects, which offer quick returns but do not sustain long-term supply. This has led to a significant decrease in the reserve life of top oil projects, now down to just 21 years, compared to 35 years a decade ago. The cost curve for oil projects has also steepened, requiring higher oil prices for new projects to be considered worthwhile. The required oil price for new projects has risen from $64 per barrel to $80 per barrel since 2014. Production growth from US shale projects is predicted to slow by 2027, suggesting a near-term peak in non-OPEC oil production.

Rise in LNG

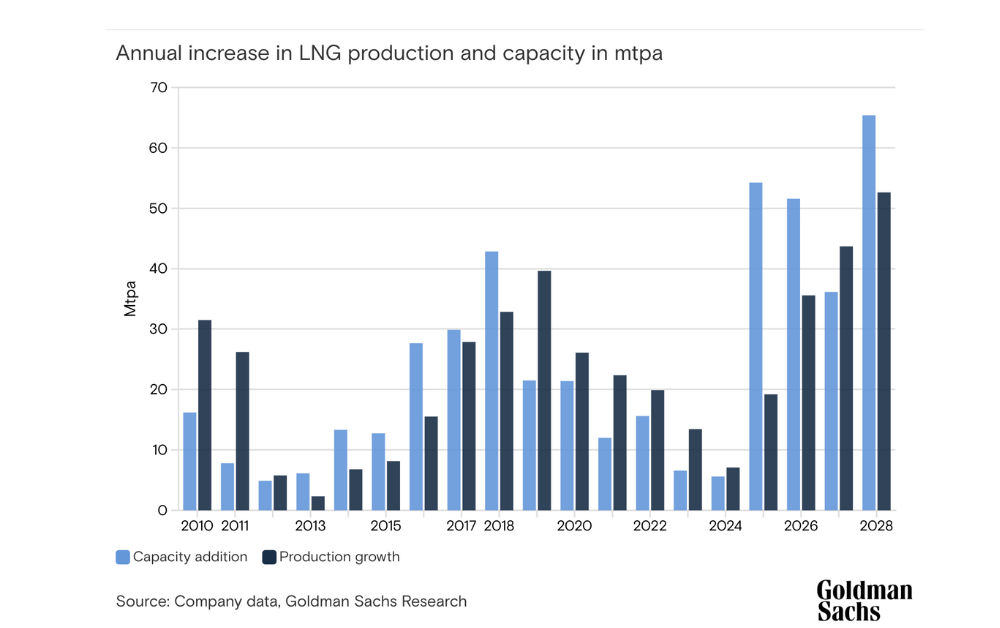

In contrast, LNG is dominating future gas supply, with the US poised to become the world's largest exporter of energy. Growing global demand for natural gas, particularly in Europe and Asia, is driving significant investment in US shale gas production, which enjoys a cost advantage. Goldman Sachs projects an 80% increase in global LNG supply by 2030, with new projects in North America and Qatar leading the way. The US is expected to double its LNG export capacity over the next three to four years, significantly impacting global gas prices. This shift, according to Goldman Sachs Research, is expected to drive a 50% growth in the global gas market during the next five years.

"We’re projecting a 54% increase by 2029, and it’s shale gas," says Della Vigna. "This not only gives a clear cost advantage to the US, but we believe those costs will continue to flatten."

Global Gas Market to Surge 50%

As those trends ripple through the industry, growth in oil investment shows signs of peaking in non-OPEC countries, while investment in liquified natural gas (LNG) is expected to increase more than 50% by 2029, according to Goldman Sachs Research. The industry had 73 major projects under development worldwide last year, 30% more than at the beginning of the decade but still 32% below the level in 2014.

Table: Goldman Sachs Research expects a wave of LNG supply in 2025

OPEC Market Share

While the outlook for oil projects is more challenging, OPEC is expected to gain market share towards the end of the decade. However, in the next two to three years, OPEC has little opportunity to increase production capacity without significantly impacting the market. This assumes OPEC maintains its current production discipline.

"If you put it all together, there is a strong opportunity for OPEC to gain market share towards the end of the decade," says the note. "But in the next two to three years, there is very little opportunity for OPEC to increase production capacity without rocking the market."

The shift in the oil and gas industry towards LNG presents a significant opportunity for the US and other major producers, but also highlights the challenges facing the oil sector. The ongoing transition towards cleaner energy sources and the emergence of new technologies will continue to shape the future of the energy landscape.

"We’ve seen a tremendous increase in consolidation, and consolidation is driving more efficiencies, a better quality of investment, and more consistent returns," Della Vigna concludes. "The industry is reacting to future challenges of potential oil demand through consolidation and capital discipline, leading ultimately to a higher-return industry."