High Gas Inventory Levels Point to Easing Market Fundamentals: IEA

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

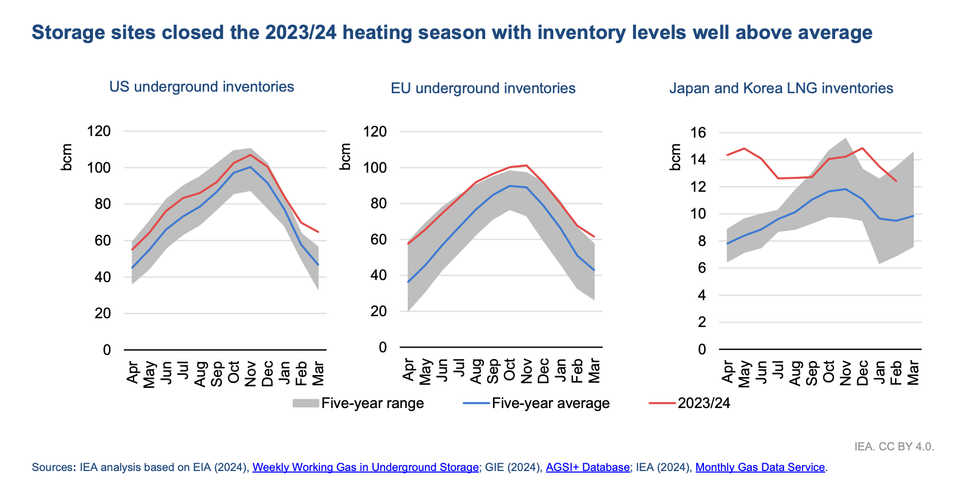

Following a mild winter with subdued demand, gas storage facilities in both the European Union and the United States have concluded the 2023/24 heating season with inventory levels significantly exceeding their five-year averages. This surplus is anticipated to reduce injection demand during the summer months, potentially leading to a further easing of market fundamentals.

In the European Union, gas storage sites finished the season 58% full, with inventories 45% above their five-year average. This is a result of both record-high starting levels in November 2023 and below-average net withdrawals throughout the winter.

"Storage injections 35% below their five-year average (or just 32 bcm) would be sufficient to reach the European Union’s 90% fill level target by the start of the 2024/25 heating season," the IEA report states. "Lower injection demand over summer 2024 could potentially contribute to a further easing of market fundamentals."

Similarly, US storage facilities ended the winter season 53% full, with inventories 40% above their five-year average. Unseasonably mild weather and continued growth in domestic production contributed to below-average storage draws.

The IEA also highlights the role of gas storage in ensuring energy security during periods of peak demand or supply disruptions. Winter Storm Heather in mid-January 2024 led to a surge in US storage withdrawals, demonstrating the importance of these reserves in mitigating potential supply shocks.

While the report primarily focuses on European and US storage levels, it also notes that closing LNG stocks in Japan and Korea were 30% above their five-year average in February 2024. However, LNG stocks held by Japan's largest power generation companies were below average at the end of March 2024.