Japanese Economic Indicators Signal Positive Trend for Stocks, Says Sumitomo Mitsui

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

A report published by Sumitomo Mitsui on Tuesday affirms a bullish outlook for the Japanese economy and its stock market, emphasizing the confluence of positive economic indicators and supportive policy initiatives. The asset management firm suggests that these factors are creating a fertile ground for sustained growth and present attractive opportunities for investors.

"We expect that the Japanese equity market will advance in the short term due to a change in the management policy of Japanese companies with a P/B ratio below 1x driven by TSE policy and earnings growth," the report states, highlighting the potential impact of the Tokyo Stock Exchange's push for improved corporate governance and management strategies.

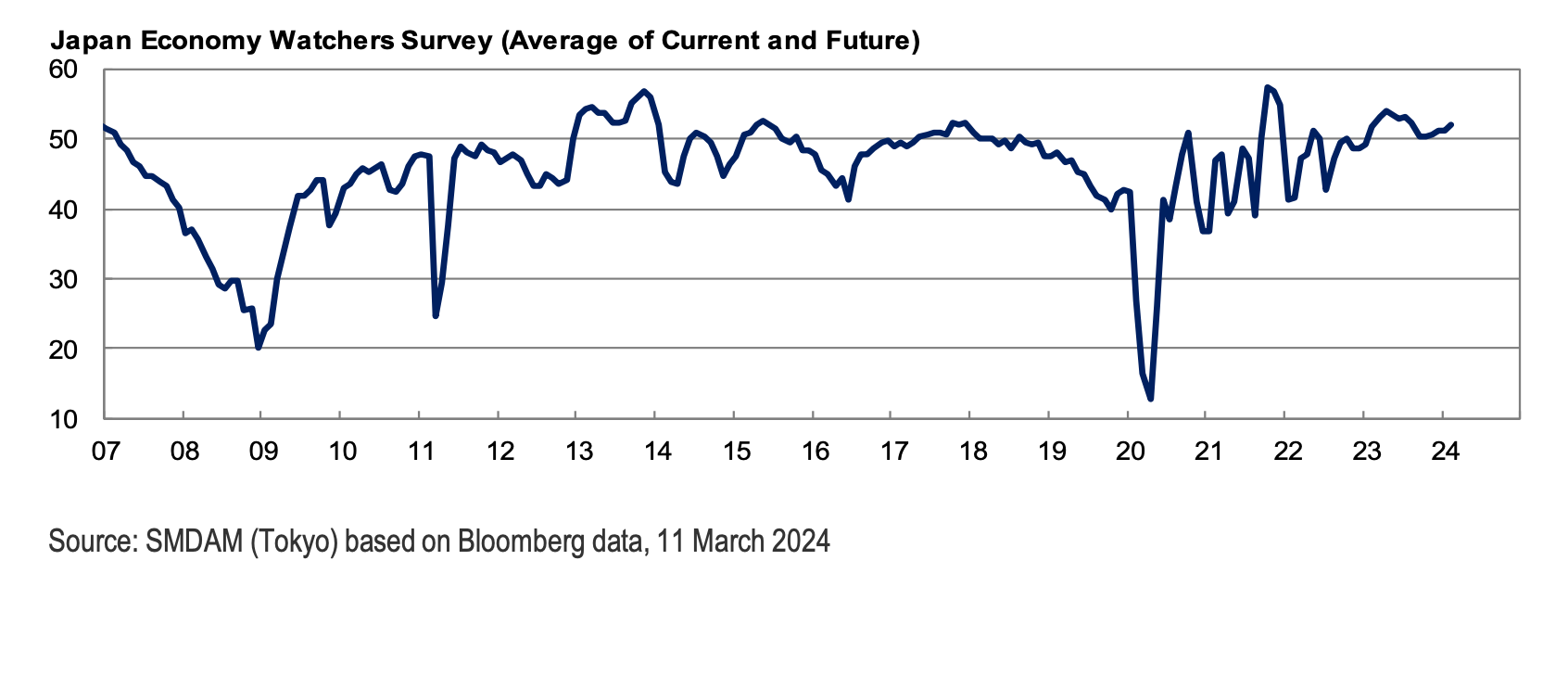

The report points to the consistent improvement in the Economy Watchers Survey, a leading indicator of economic sentiment, as a key driver of this optimism. The survey has shown continuous growth for four consecutive months, reflecting a resurgence in sectors such as tourism, hospitality, and retail, fueled by the rebound in inbound tourism and increased domestic consumption. Additionally, advancements and increased capital investment within the semiconductor industry are generating positive ripple effects across the broader economy.

Sumitomo Mitsui also also emphasizes the role of rising wages and a burgeoning "wealth effect" in supporting the positive trajectory of the stock market. With the Nikkei 225 reaching record highs and government initiatives encouraging wage increases, consumer spending power and overall economic sentiment are expected to strengthen.

The report identifies several factors that are likely to sustain this growth momentum. "Over the long term, policies that are more open to foreign capital, including an improvement in corporate governance, as well as policies to boost the immigration intake, are likely to support the market," the report states, highlighting the importance of attracting foreign investment and addressing labor shortages for long-term economic expansion.

While acknowledging potential risks such as financial crises and global recessionary pressures, Sumitomo Mitsui maintains a positive outlook for the Japanese stock market. The report recommends an investment strategy focused on companies with low price-to-book ratios, strong cash positions, and significant unrealised gains on land holdings, as these factors offer potential for value appreciation and provide a buffer against potential economic headwinds.

As of March 27, the Nikkei 225 has gained 22% YTD and continues to be one of the best performers in 2024.