Mutual Funds Embrace Leverage, Pushing Treasury Futures Holdings to Record Highs

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

Mutual funds are increasingly turning to Treasury futures to gain exposure to rising interest rates and boost returns, according to a research note published by the Federal Reserve last week. The study reveals a surge in mutual funds’ net long positions in Treasury futures in recent months, reaching record high levels.

“In part, the elevated long futures exposures appear to reflect asset managers' demand for interest rate exposure amid a higher interest rate environment," the authors of the note explains.

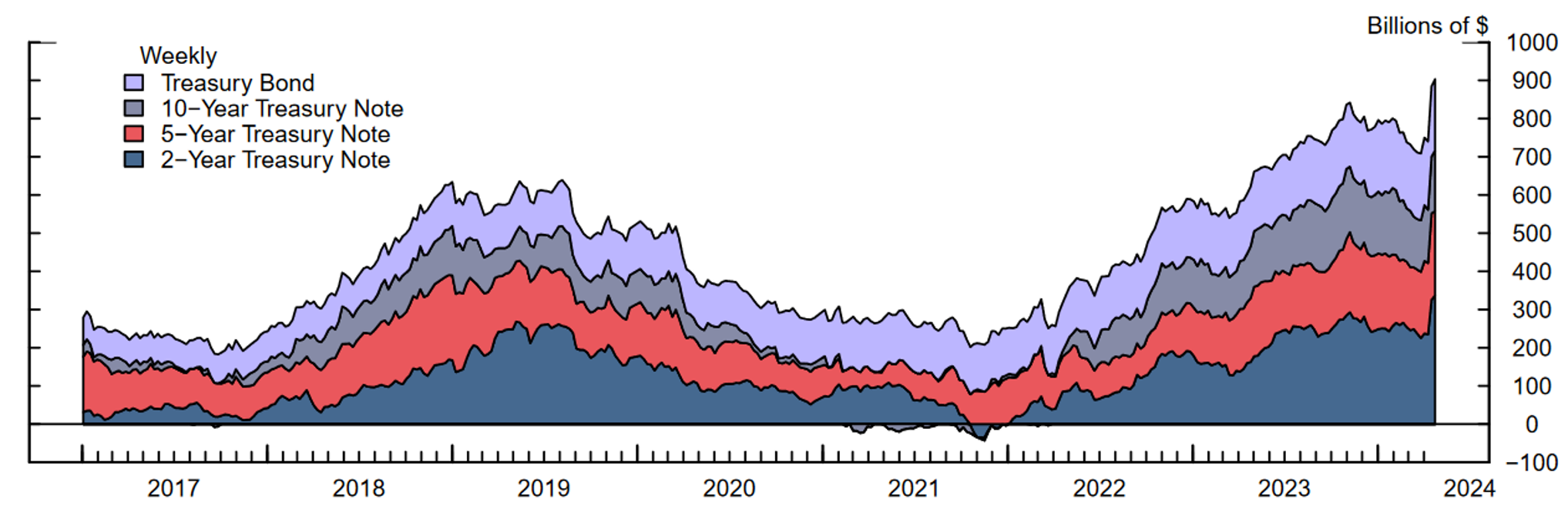

Chart 1: Asset Managers' Net Position in Treasury Futures

Mutual funds now hold approximately $500 billion in Treasury futures, a $220 billion increase since the end of 2020. This surge reflects both a heightened overall demand for Treasury exposures and a growing preference for acquiring those exposures through futures rather than directly holding Treasury securities.

While mutual funds’ total Treasury exposures (including both futures and securities) have grown largely in line with the increase in outstanding Treasury securities, the share of those exposures sourced through futures has jumped from about 30% in mid-2022 to 43% by the end of 2023.

The Fed researchers posit several reasons for this shift towards futures. The embedded leverage in futures contracts allows funds to control a larger position with less capital, potentially amplifying returns. This is particularly attractive for funds seeking higher yields, especially as many are drawn to riskier assets in the corporate bond market.

“Treasury futures facilitate such behavior by allowing mutual fund managers to increase their allocations to credit and other riskier assets while using futures to keep the portfolio duration aligned with their benchmarks,” the note states.

Futures also offer advantages over repo borrowing, another way to achieve leveraged Treasury exposure. Mutual funds traditionally faced regulatory limits on repo borrowing, and the associated interest expenses could negatively impact their expense ratios. Futures provide a way to leverage without these drawbacks.

Additionally, the high liquidity and centralized trading of Treasury futures make them efficient tools for managing interest rate risk and quickly adjusting exposures, particularly valuable for funds with volatile investor flows.

While the researchers acknowledge the need for further study to establish definitive causal relationships, the data strongly suggests that leverage, regulatory considerations, liquidity, and the pursuit of higher yields are all contributing to mutual funds’ growing appetite for Treasury futures.

"Overall, this comparative analysis shows that futures usage in mutual funds is associated with greater risk taking, greater flow volatility, and higher expense ratios," the note concludes. "These findings suggest that although mutual funds have various uses for Treasury futures, many funds use the embedded leverage in futures to increase portfolio risk and reach for yield."