Nikkei's Long-Term Uptrend Intact Despite April Setbacks: Nikko Asset Management

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

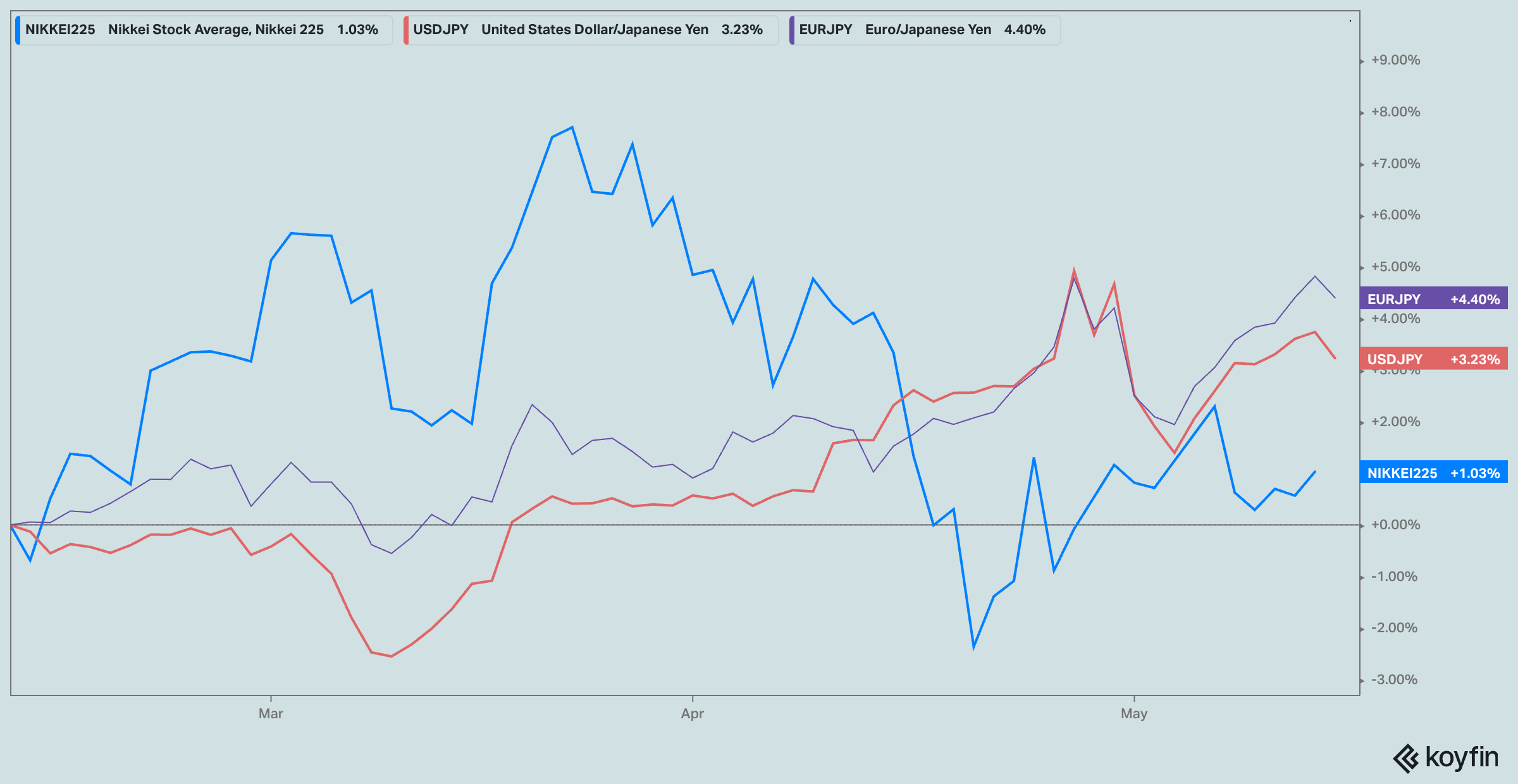

The Nikkei Stock Average has retreated from its record high above 40,000, closing April down 4.86% as the TOPIX also fell 0.91%. While the Bank of Japan's decision to maintain its monetary policy offered some support, the Japanese equity market faced headwinds from multiple fronts.

Escalating tensions in the Middle East fueled a risk-off sentiment among investors, while the decline in U.S. equities, driven by fading hopes of early Fed rate cuts in light of strong economic data, further dampened market sentiment. Semiconductor-related stocks, instrumental in the Nikkei's earlier surge, also weighed on the market after a major Taiwanese chip manufacturer scaled back its growth forecast.

Disappointing earnings results from both domestic and international companies added to the negative sentiment.

Despite these challenges, Nikko Asset Management maintains its optimistic outlook for Japanese equities in a note published on Friday, predicting the Nikkei to reach 45,000 by March 2025.

The report cites two primary reasons for this continued confidence. Firstly, Middle Eastern tensions, which initially sparked a decline in Japanese stocks, have not significantly impacted oil prices as feared. "The market has had an opportunity to observe that actual oil-producing nations were relatively unaffected by this recent surge in geopolitical tensions," says the asset management firm.

Secondly, the recent pullback is viewed as a necessary adjustment after a sharp rally in March, particularly for the semiconductor sector, which played a key role in the Nikkei's record-breaking climb.

Looking ahead, Nikko Asset Management believes the Japanese market will benefit from a broader focus on sectors beyond semiconductors and exporters, who have been the primary beneficiaries of the weak yen.

"Other sectors with growth potential, such as travel and hospitality, banking, retail sales and real estate, could benefit from actual economic expansion," the note states. "Even if the yen appreciates over time, Japan still possesses numerous potential growth narratives supported by fundamentals."