Oil Prices Set to Moderate as OPEC+ Output Cuts Phase Out, Fitch Ratings Says

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

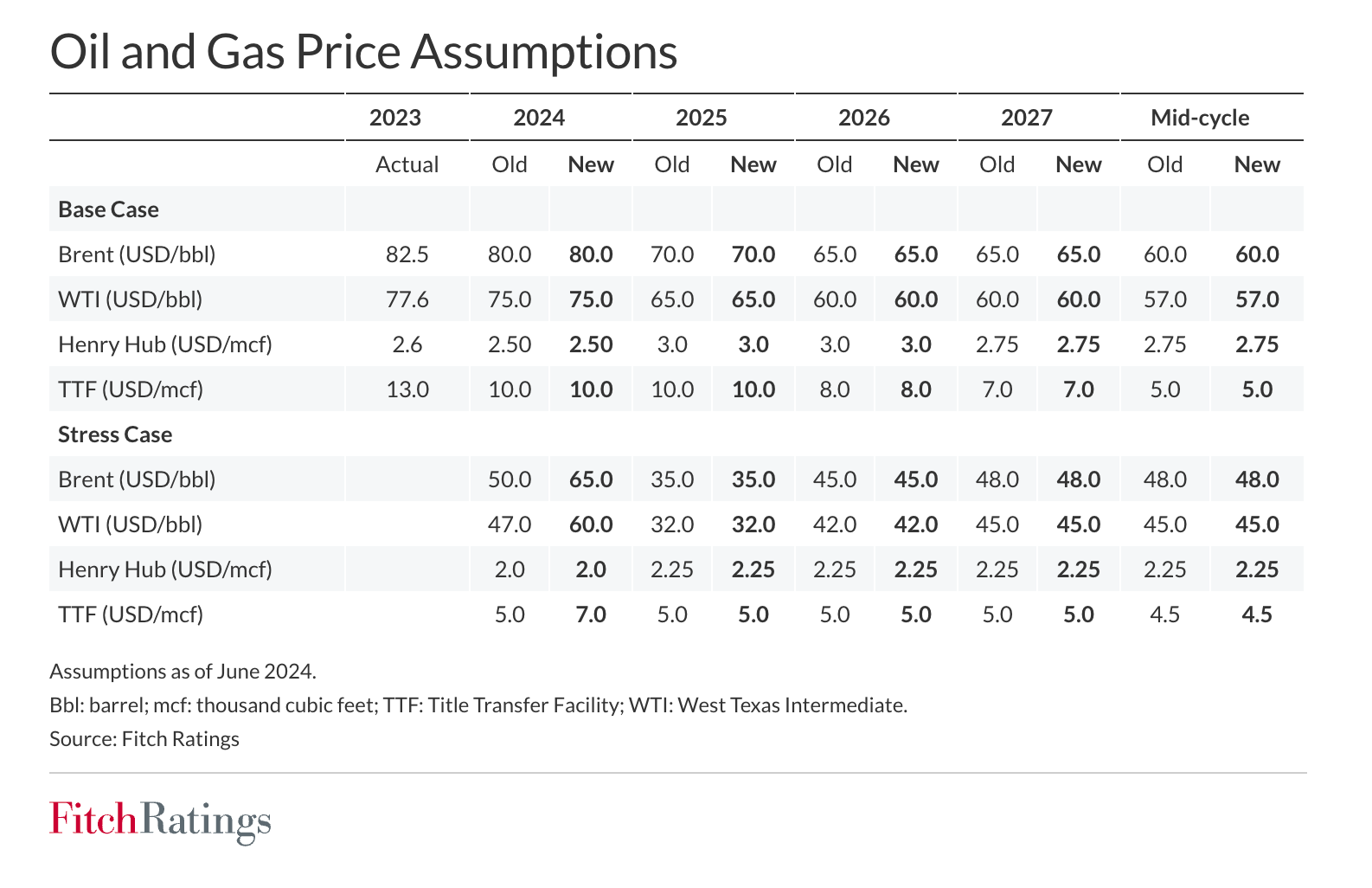

Oil prices are expected to moderate in the coming months as OPEC+ phases out additional output cuts, according to a new update from Fitch Ratings. While Brent crude oil prices reached USD90 a barrel in April due to heightened tensions in the Middle East, prices have since declined as those concerns subsided.

The recent OPEC+ decision, announced in early June, to gradually phase out additional output cuts, totaling 2.2 million barrels per day (MMbpd) by September 2025, has contributed to the downward pressure on prices. This move, coupled with near-record oil production in the US and rising inventory levels globally, could push the market into a surplus in 2025.

"OPEC+ highlighted that the return of these volumes to the market would depend on market dynamics and could be paused," says Fitch Ratings.

Fitch expects global oil consumption growth to continue in 2024-2025, though at a slower pace than in previous years. Global oil demand growth will fall to 1.1 MMbpd in 2024, down from 2.3 MMbpd in 2023, driven by factors like electric vehicle expansion, efficiency gains, and slower growth in China. Demand growth is expected to remain at a similar level in 2025.

Fitch projects global production growth to be well below 1 MMbpd in 2024, largely due to OPEC+'s production discipline. However, growth is expected to accelerate to well above 1 MMbpd in 2025, driven by strong non-OPEC+ production increases, mostly in the US, Canada, and Brazil.

"OPEC+'s ample spare capacity of 5.9MMbpd limits potential increases in oil prices and contains the geopolitical risk premium," Fitch Ratings states.

Meanwhile, Fitch has maintained its base-case price assumptions for natural gas, with US gas production continuing to outstrip consumption, though the gap has narrowed. Natural gas prices remain volatile, influenced by weather patterns, particularly in the short term.

The EU gas storage is currently 68% full, and Fitch believes EU countries will be able to fully refill storage before the heating season, limiting upward price pressure. However, the firm forecasts a seasonal increase in prices in autumn, in line with the usual natural gas price seasonality.

"We maintain our view that natural gas markets will remain fairly tight in 2024 and 2025, with new liquefied natural gas capacity in the US and Qatar leading to a gradual decrease in prices from 2026," says Fitch Ratings.