Private Equity Exits Remain Muted Despite Market Highs, Prompting Focus on Secondary Deals

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

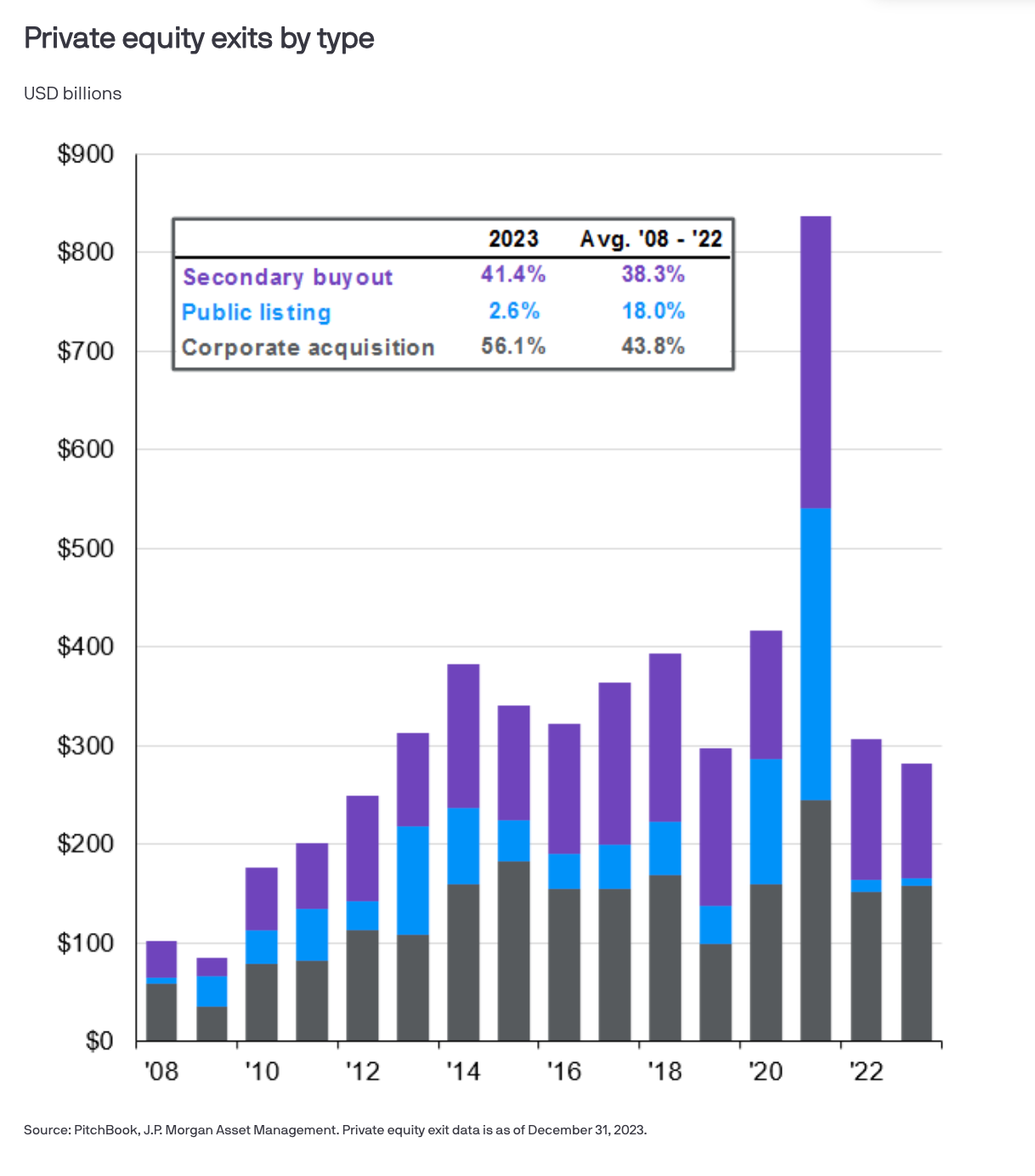

Despite public equity markets reaching record highs and improving economic outlooks, private equity (PE) exit activity remains surprisingly subdued, prompting investors to turn towards the secondary market for liquidity. A recent report from JPMorgan highlights this trend, raising questions about the future of PE exits.

"Muted exit activity has been surprising as public equity markets repeatedly reach all-time highs this year, valuations rise, and earnings expectations improve," observes JPMorgan. While PE has shown resilience during the Fed's hiking cycle, with returns outperforming U.S. small-cap stocks, deal and exit activity has lagged due to economic uncertainties and previous overallocation to alternative assets.

S&P Global reports that the value of global private equity-backed exits sank to a three-year low in the first quarter of 2024, down 22% from the previous year.

"When you take it in the context of the liquidity-driven period of ‘20 and ’21, there was a lot of capital around,” notes Dave Stadinski of Piper Sandler on S&P Global's podcast, suggesting that companies may be delaying their return to capital markets after securing significant funding during that time.

The sluggish IPO market is a key factor contributing to the slowdown. The first quarter of 2024 saw the lowest number of IPOs since 2020, marking a nearly 70% decline since 2021. While high-profile IPOs and improving public market momentum may offer some optimism, JPMorgan anticipates only a modest recovery in exit activity, noting that central bank easing is expected to be limited.

With traditional exit avenues facing challenges, the secondary market is emerging as a critical source of liquidity for investors who can find another buyer. JPMorgan highlights the growth in secondary deals, driven by significant dry powder and the potential for improved pricing and J-curve mitigation. The report suggests that smaller and mid-market deals may offer particularly compelling opportunities due to their growth potential and diverse exit options.

The market is also seeing an upswing in M&A activity despite higher interest rates, reports S&P Global. The trend is attributed to the growing challenge faced by venture capital-backed startups in securing additional funding rounds. With dwindling resources and declining valuations, the decision to sell to another company becomes more appealing as the feasibility of remaining private for extended periods diminishes.

According to data cited by S&P Global, global PE exits totaled $81.2 billion in the first quarter of 2024. Cisco Systems Inc.'s $28.5 billion acquisition of cybersecurity firm Splunk Inc., was the largest private-equity-backed exit to close in the first quarter.

According to industry data cited by S&P Global, global PE exits totaled $81.2 billion in the first quarter of 2024. Cisco Systems' acquisition of cybersecurity firm Splunk Inc., for $28.5 billion, was the largest private-equity-backed exit to close in the first quarter.