Tech Optimism Helps Offset Macro Worries: UBS

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

Strong earnings results from Microsoft and Alphabet have boosted optimism in the tech sector and helped offset concerns over the US economic outlook, according to an article published by UBS. S&P 500 futures pointed to a positive end to the week for equities, as investors cheered the tech giants' reports.

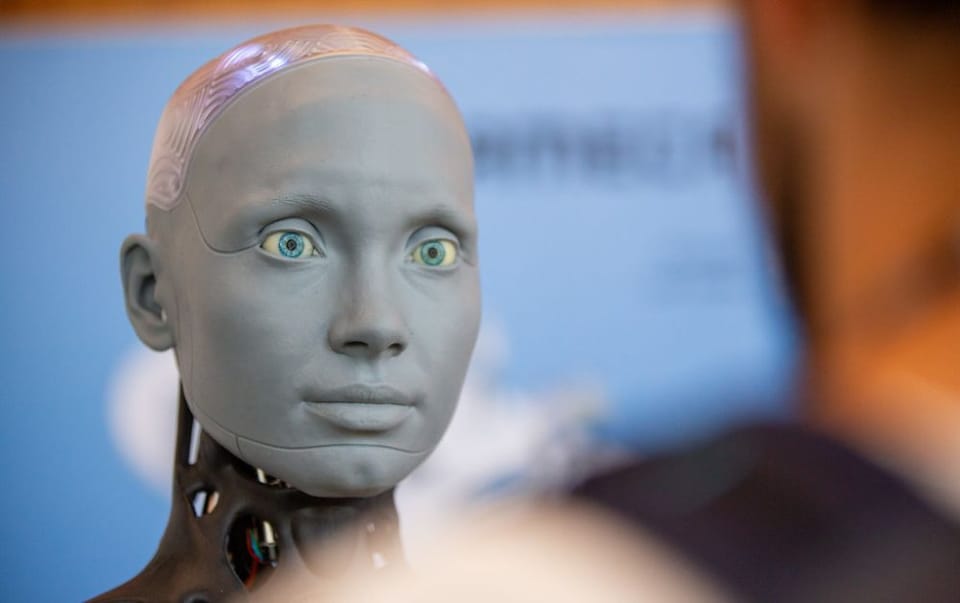

Microsoft and Alphabet's revenues and earnings both exceeded expectations in the first quarter, driven by robust demand for cloud-computing and AI-related services. These results have restored confidence in the growth potential of artificial intelligence and technology, which had been dented by fears of slowing demand for semiconductors.

Read More: Global Economy Shows Signs of Sustained Growth

Despite ongoing macroeconomic uncertainties, UBS remains positive on the tech sector due to several key reasons:

Accelerating Capital Spending on AI Pays Off: Tech companies are ramping up their investments in AI, which is paying off in terms of earnings growth. Meta, Alphabet, and Microsoft have all committed to increasing their AI spending, with total capital outlays reaching an estimated $140 billion this year. UBS expects the broad tech sector to experience faster profit growth, with earnings per share rising 20% in 2024 from 18% previously, and at 16% for 2025.

Improving Cash Flow Generation: Big tech companies are generating strong cash flows, allowing them to sustain their AI investments while also returning capital to shareholders through share buybacks. UBS expects combined free cash flows to grow from $460 billion in 2024 to $560 billion in 2025.

Reasonable Valuations: Global tech valuations remain reasonable at 22.5 times 2025 forecast earnings, while big tech is trading at 25 times earnings. UBS believes this premium is justified given their strong earnings momentum.

"With tech fundamentals staying robust, in particular from big tech in the first quarter, we continue to highlight the recent correction has provided interesting entry points for tech and AI-related stocks," UBS concludes.