REITs: An Overview

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

Author: Bruce Liegel

I was recently asked to weigh in on REITs, and here are my quick thoughts.

What are REITs?

A REIT is a real estate investment trust, or simply an investment vehicle for companies to sell a stake in their firm via an equity offering. REITs give the investor exposure to a variety of real estate assets.

There are many types of REITs. Some of the biggest types and names include warehouse facilities offered by Prologis (PLD), office towers offered by American Tower (AMT), public storage offered by Public Storage (PSA), communication infrastructure offered by Crown Castle (CCI), and large data centers offered by Equinix (EQIX).

There are dozens of other types of REITs in the US and globally. Everything from Timber to Health Care facilitates to Hotels and Resorts. One common characteristic that they all have is a high correlation to interest rates and leverage— lots of debt which needs to be refinanced continuously.

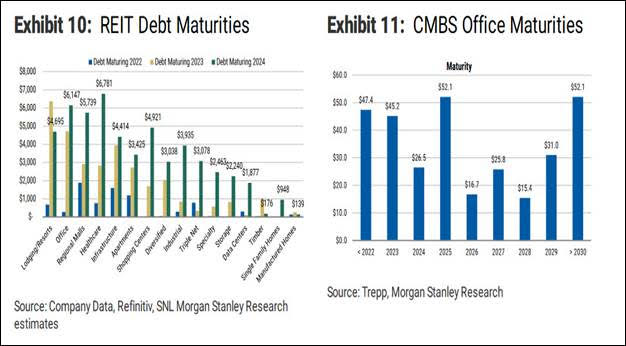

Below is a graph showing the amount of REIT debt that is up for refinancing by type. With interest rates close to 5% in recent years — many of these firms are under severe stress to refinance properties and keep them profitable.

One way to get exposure to them in a diversifies portfolios is via an ETF.

IYR is the iShares U.S. Real Estate ETF, while VNQ is the Vanguard Real Estate ETF. Both funds give you exposure to dozens of different kinds of REITs.

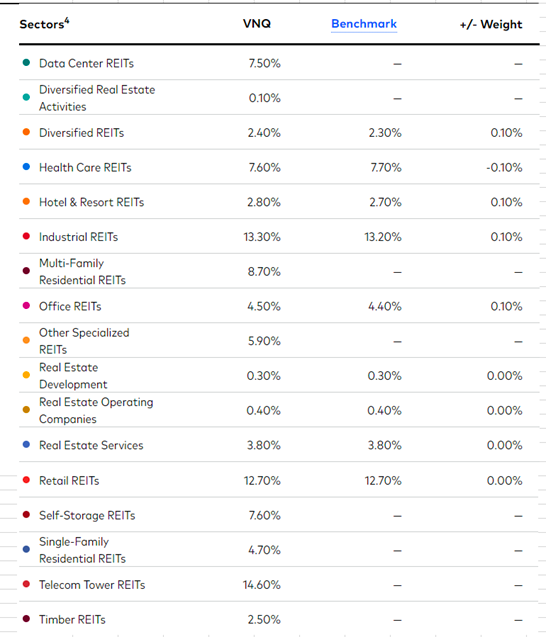

Below is the Sector breakdown for the VNQ. You can see from here the variety of different sectors that you get from investing in an ETF that focus primarily on REITs

Why should investors consider REITs?

REITs are great investments when the central banks are not in a tightening mode — as they are today. However, many REITs offer a very high dividend yield due to the fact that they are required to pay out 90% of their taxable income to shareholders annually. The more leverage/debt that a particular REIT has, the higher potential return it can offer. Conversely, when rates are rising this leverage or debt load can be a huge negative. As I mentioned in my deep dive article.

Financial metrics to watch out for

For a REIT investor, debt leverage is a top metric to pay close attention to, as is interest rate expense in today’s market environment. Too much debt is causing liquidity issues on a number of REITS — resulting in refinancing and cash flow issues.

Closing thoughts

I like REIT ETFs because they give you more diversification—either IYR or VNQ. Both are very liquid, and have low costs. I would hold off investing until the Federal Reserve is near completion of its hiking cycle. Because of the high dividend rate, once interest rates start moving lower — REITs have shown to be a great investment