Treasury Signals Stable Debt Issuance, Calming Market Jitters

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

The US Department of the Treasury announced plans to raise approximately $17.2 billion through Treasury securities auctions next week, indicating a stabilization in borrowing needs after several quarters of increases. This news brought some relief to Treasury investors who have been closely monitoring the government's debt issuance plans.

Moody's Analytics reports that the Treasury Department expects to borrow $243 billion in the third quarter of fiscal 2024, a significant increase from the previous year but lower than initially projected. This revised borrowing estimate reflects lower-than-anticipated receipts. The Treasury also anticipates needing an additional $847 billion in the fourth quarter, bringing the total expected borrowing for fiscal 2024 to $1.84 trillion, about 30% lower than in fiscal 2023.

The recent announcement suggests a shift from the aggressive borrowing strategy communicated in July, which had caused a surge in yields on longer-dated Treasury securities. The Treasury's focus on shorter-term note issuance has helped stabilize the market, and steady borrowing in the coming quarters is expected to maintain relative stability in Treasury yields.

"Treasury auction sizes are stabilizing after rising for three straight quarters. This should add some calm to Treasury investors, who have been keenly tuned in to recent refunding announcements," notes Moody's Analytics.

The Treasury Department also announced a new buyback program for nominal coupon securities and Treasury Inflation-Protected Securities (TIPS), further contributing to market stability. This initiative marks a return to buyback operations, which were last conducted in the early 2000s during a period of budget surplus.

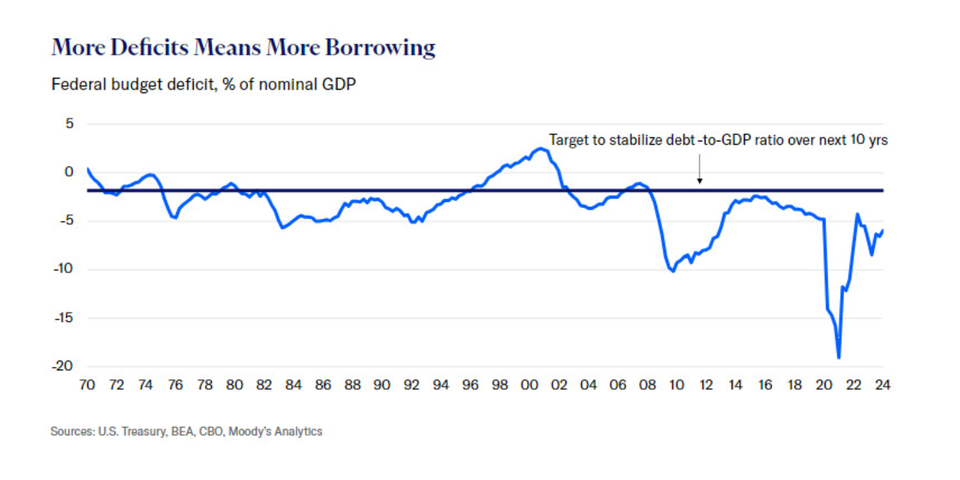

Despite the recent calming effect, concerns remain about the US's long-term fiscal health, with the debt-to-GDP ratio exceeding 98% in the first quarter of fiscal 2024. Moody's Analytics projects this ratio to rise to 113% by 2034, driven by increased borrowing to finance higher spending, particularly on mandatory budget items and debt servicing costs.

"Quarter refunding announcements continue to attract a high level of attention, as concerns over the U.S.’s deficit-riddled fiscal outlook are keeping Treasury debt investors anxious," observes Moody's Analytics. "However, in the near term, the Treasury’s emphasis on shorter-term note issuance has been a stabilizing force for Treasury markets. Steady borrowing in future quarters, as the Treasury anticipates, should keep Treasury yields relatively stable in the near term."