Trump and Bond Yields

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

Donald Trump's decisive victory in the presidential race, dubbed by some as the "Super Bowl of Global Politics," triggered mixed reactions across financial markets. While stock indices hit record highs, the US dollar surged, and Bitcoin soared, the bond market responded with a resounding sell-off.

This divergence highlights the unique challenges a second Trump term presents for fixed-income investors. Instead of joining the rally, the $28 trillion US government debt market experienced a decline following Trump's win. Investors drove yields on the benchmark 10-year Treasury note up by as much as 18 basis points to 4.47 percent the day after the election, a multi-month high. This rise in yields signifies a drop in bond prices, as the two have an inverse relationship. Crucially, rising yields also increase the cost for the U.S. federal government to finance its debt.

The Return of the Bond Vigilantes

This market reaction stems from the anticipation that the federal government under Trump will continue its high deficit spending while the Federal Reserve maintains an accommodative monetary policy. Consequently, some investors are shorting the bond market, predicting further increases in long-term rates.

This sell-off suggests the return of "bond vigilantes" – investors who push government borrowing costs higher to pressure policymakers to control spending. In this case, the pressure is on the self-proclaimed "King of Debt" himself. These fixed-income investors are concerned that Trump's policies will escalate inflation and dramatically increase the national debt.

The rising interest rates are effectively a market penalty for this perceived risk. These increased borrowing costs could potentially dampen Trump's projected economic growth and adversely affect other financial markets.

Inflationary Fears Under a Second Trump Term

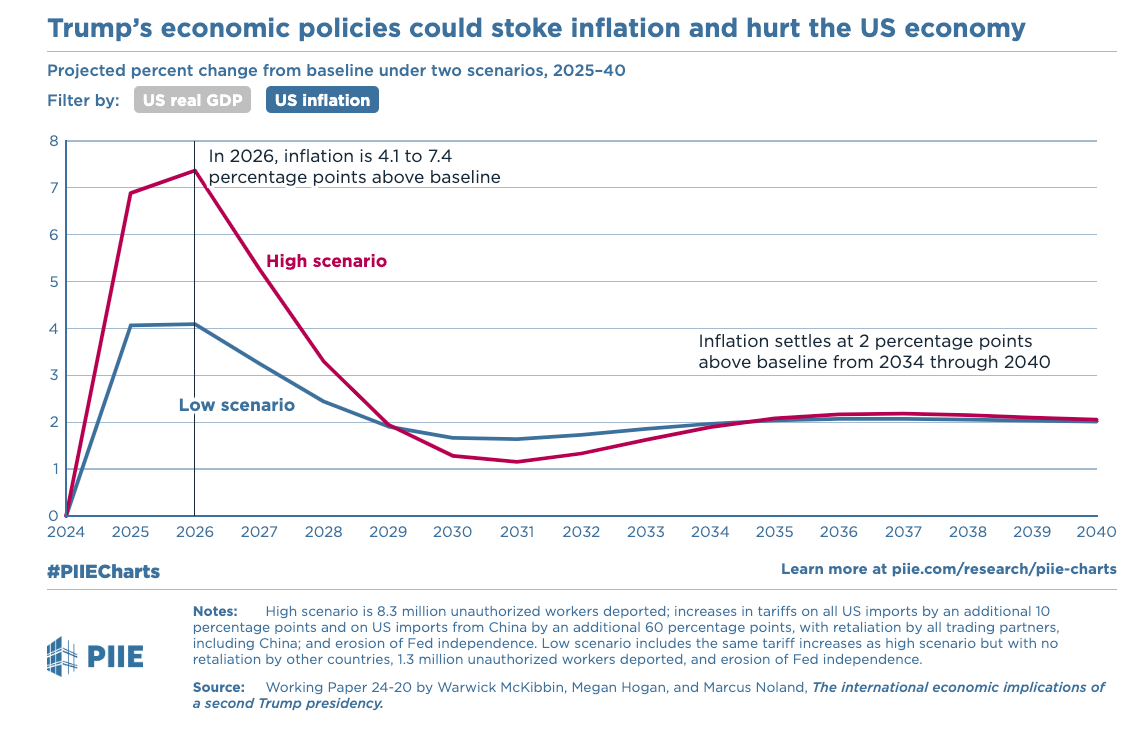

The market's apprehension is understandable. Economists and market analysts have long predicted a potential rise in inflation during a second Trump presidency, fueled by his proposed economic policies. The Peterson Institute for International Economics, for example, projects inflation could reach between 6% and 9.3% by 2026, considerably higher than the baseline projection of 1.9%. This concern is serious enough that sixteen Nobel laureates in economics signed a letter in June warning that Trump's proposals could "reignite" inflation, which, after peaking at 9.1% in 2022, has fallen significantly and is nearing the Fed’s 2% target.

Jonathan Levin of Bloomberg sums up these fears well:

Throughout the campaign, Trump spooked most mainstream economists with his comments about 60% tariffs on Chinese imports and duties of as much as 20% on all others. He also promised mass deportation of undocumented immigrants, which could dramatically curb labor supply in key fields such as construction and child care, in addition to the toll it would take on families. Add to that the eye-popping deficit math of actually implementing Trump’s various tax promises (expanding the 2017 tax cuts, no tax on tips, etc.) and you can understand why inflation concerns have resurfaced and fixed-income traders have demanded a premium for the emerging risk.

Impact on Different Bond Types

Trump's re-election could significantly impact various types of bonds, both positively and negatively:

Negatively Impacted:

- US Treasury Bonds: These are particularly vulnerable. Increased government debt resulting from tax cuts and potentially higher spending under a second Trump term is expected to put upward pressure on yields. Moreover, anticipated inflation could erode the value of fixed-income investments, leading investors to demand higher yields on Treasuries. Shorter-term Treasury notes are especially sensitive, as their yields are closely tied to Fed policy expectations, and the market foresees fewer rate cuts than previously anticipated.

- Municipal Bonds: Although generally less volatile than corporate bonds, municipal bonds could be indirectly affected. As Treasury yields rise, other fixed-income investments become comparatively more attractive, potentially putting downward pressure on municipal bond prices. Additionally, substantial economic changes under Trump's policies could impact the financial health of state and local governments, influencing the credit risk of their bonds.

Potentially Positively Impacted:

- Corporate Bonds: While corporate bonds could also be affected by rising interest rates overall, some sectors might benefit. Companies in industries aligned with Trump's policies, such as energy (through deregulation) or infrastructure (through increased spending), could experience improved credit outlooks and higher demand for their bonds.

- Inflation-Protected Bonds (TIPS): If inflation rises as predicted under Trump's policies, TIPS could perform well. These bonds are designed to safeguard investors from inflation, as their principal is adjusted based on the Consumer Price Index (CPI). Higher inflation would lead to higher payouts on TIPS, making them a potentially attractive investment.

Bottom Line

Trump's plans might not be as inflationary as some fear. He may moderate certain aspects if faced with strong resistance from the bond market. A rise in long-term yields toward 5% could also attract some investors. Nevertheless, as long as US debt and deficits remain high, they will be points of vulnerability.