Trump's Quest for Cheap Energy

For the past 50 years, every U.S. president has made it a priority to advocate for cheap and secure energy. Donald Trump is no exception. His campaign promises include a pledge to "drill, baby, drill" and cut energy costs for Americans by half.

This focus on energy isn’t surprising: it’s backed by both politics and economics. Research studies show gasoline prices significantly influence U.S. voters, and have an "outsized effect" on inflation expectations and consumer sentiment. The 1980 presidential election offers a prime example. The spike in oil prices during Jimmy Carter's presidency fueled inflation and economic instability, leading to long gas lines and anxieties about energy security, ultimately contributing to his defeat.

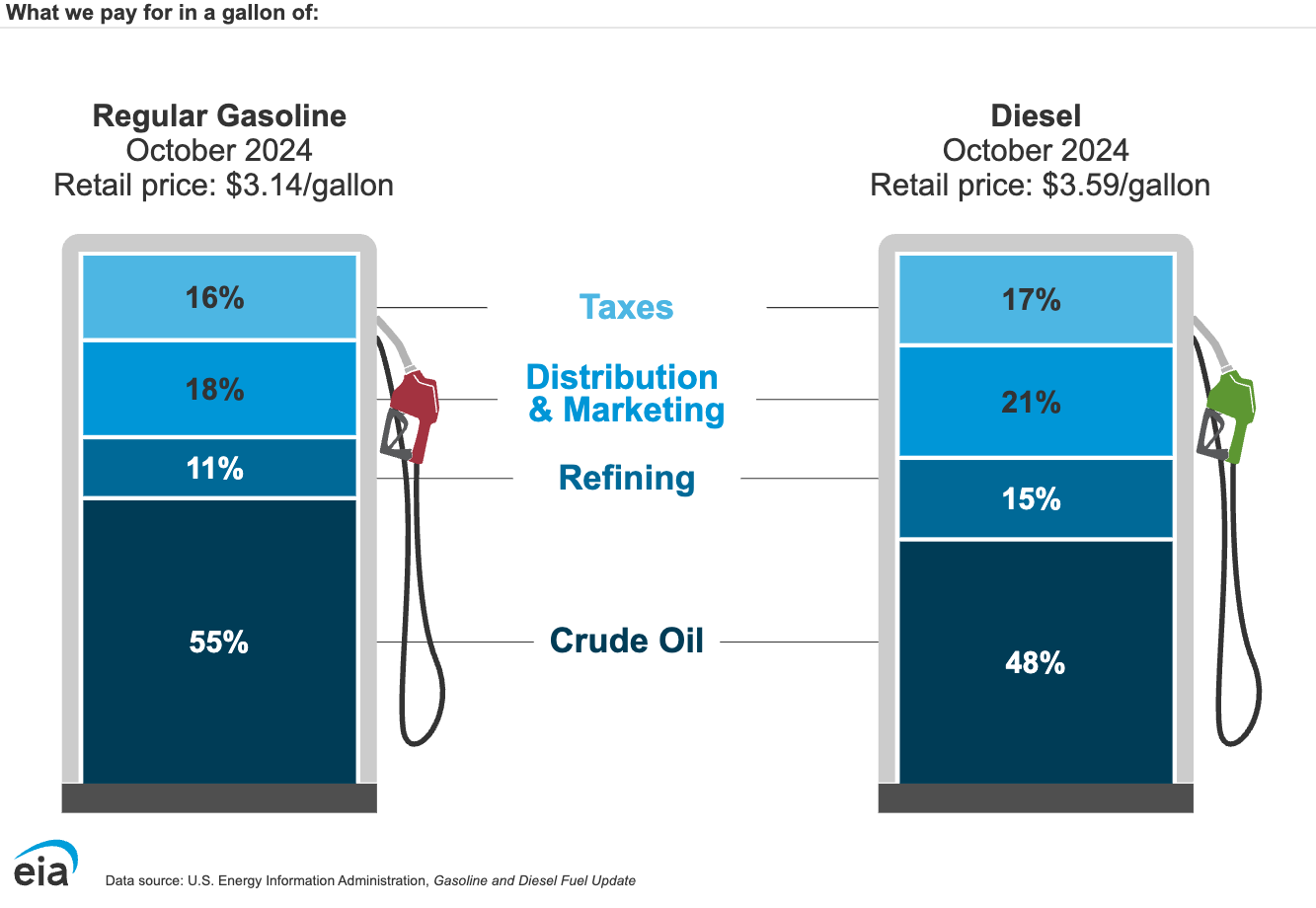

Despite the political rhetorics, the power of a U.S. president to control energy prices is actually limited. More than 50% of gasoline prices are dictated by the cost of crude oil, which is determined by international markets rather than domestic policy.

Complicating matters further, while the U.S. produces enough oil to meet its own consumption needs, it remains deeply entrenched in global oil markets. In 2015, Congress lifted a 40-year ban on crude oil exports, allowing U.S. companies to sell their oil to the highest international bidder. Adding to the complexity, some U.S. refineries are built to process only certain types of crude oil, which must be imported. International events and foreign production decisions – neither of which are under a U.S. president’s control – further shape the energy landscape.

So, how likely is Trump’s promise of lower energy costs in the short term? We need to unpack the key variables influencing energy prices:

Domestic Production

Trump’s energy strategy revolves around achieving "energy dominance." Central to this vision is a pledge to expand domestic oil and gas production by rolling back environmental regulations, including those enacted during the Biden administration. However, enthusiasm for this approach is not shared by the energy industry.

At a recent energy conference, Liam Mallon, head of Exxon’s upstream division, noted: "We’re not going to see anybody in 'drill, baby, drill' mode." He explained that a radical shift in production is unlikely, as most companies remain focused on profitability rather than volume.

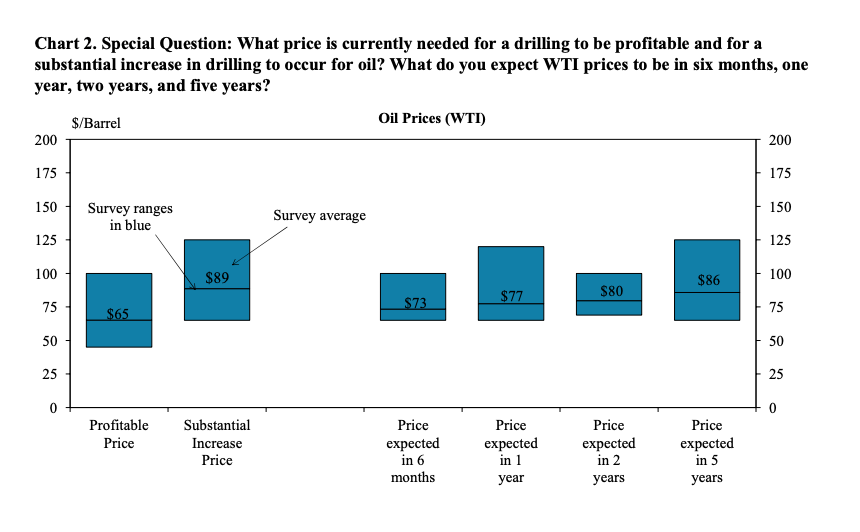

Ultimately, production decisions are driven by price. According to the Federal Reserve of Kansas City, the average break-even price for U.S. drilling is approximately $65 per barrel of WTI crude, and prices would need to rise closer to $90 per barrel before producers will significantly increases their production.

With WTI crude currently trading around $67 per barrel, skepticism about Trump’s proposals is widespread. "We don’t believe there will be a response from U.S. onshore crude production after President-elect Trump takes office," said Hunter Kornfeind, an oil analyst at Rapidan Energy Group, speaking to the Financial Times. "You can’t have low crude prices, as President Trump campaigned on, at the same time as robust production growth. It’s just not reality."

OPEC+ Production

Another major uncertainty lies in the actions of OPEC+, the coalition of oil-producing nations that includes Saudi Arabia and Russia. Just last week, OPEC+ decided to delay any increase in production quotas until at least April 2025. This sets up a potential clash with Trump’s plans to ramp up U.S. drilling.

This was the third time since June that OPEC+ postponed a planned output increase. The group is currently withholding as much as 6% of global oil supply. Their reluctance to pump more reflects concerns that oversupplying the market could cause prices to crater, especially as demand from China and other major importers remains weak.

Yet, OPEC+ is not without internal challenges. Compliance with production limits has been shaky, with some members, like Iraq and Kazakhstan, exceeding their quotas. Bloomberg's Javier Blas calculates that OPEC+ countries subject to output caps have overproduced by more than 600,000 barrels per day since the beginning of the year, reaching nearly 850,000 barrels per day in August. This overproduction undermines the cartel's ability to manage prices and fuels skepticism about its ability to push prices higher in 2025.

Global Demand

Slowing global economic growth is dampening the demand for oil. While global demand is projected to reach 103 million barrels per day (mb/d) in 2024, the World Bank expects growth to slow to just 1 mb/d in 2025, compared to a 2 mb/d increase in 2023. This sluggish growth is particularly concerning given the outlook for China, which represents 15% of global oil demand. China's oil demand has already contracted for six consecutive months through September, and its consumption is expected to peak next year. Trump's proposed tariffs on Chinese goods could further weaken demand, exacerbating the downward pressure on oil prices.

Geopolitics

Geopolitical risks, in particular the tension in the Middle East, add another layer of complexity. While the recent Israel-Hamas conflict has had a limited impact on oil prices thus far, a wider escalation involving Iran could significantly disrupt the market. This presents a dilemma, as noted by the Financial Times' Robert Armstrong: a strong stance against Iran, including sanctions, could tighten the oil market and drive up prices, directly undermining the domestic goal of lower energy costs. Iran currently produces approximately 1 million barrels of oil per day, making its potential removal from the market a significant factor.

U.S. Natural Gas Exports

While the U.S. largely insulates its natural gas market from global pressures, this could change as the industry expands its export capacity to capitalize on higher prices in Europe and Asia. Goldman Sachs projects that U.S. LNG exports could more than double by 2030, reaching 189 million metric tons per annum and increasing the U.S. share of the global LNG market from 22% to 31%. This surge in exports, however, could tighten domestic natural gas supplies, potentially leading to higher prices for American consumers by 2025 and beyond

Bottom line: Trump's energy ambitions face a catch-22: lower prices discourage domestic production, creating a floor for how low prices can go. A dramatic reduction in energy costs will be unlikely. Last week, Morgan Stanley reinforced this view by raising its Brent forecast for the second half of 2025 to $70 from $66-68 per barrel.