US Consumer Borrowing Growth Slows Amidst High Interest Rates

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

The pace of consumer borrowing in the United States has slowed dramatically after a period of rapid growth in the wake of the pandemic, according to a report by Moody's Analytics published last week. Several factors are contributing to this trend, including high interest rates, tightening lending standards, slowing spending growth, and concerns about a potential weakening of the labor market.

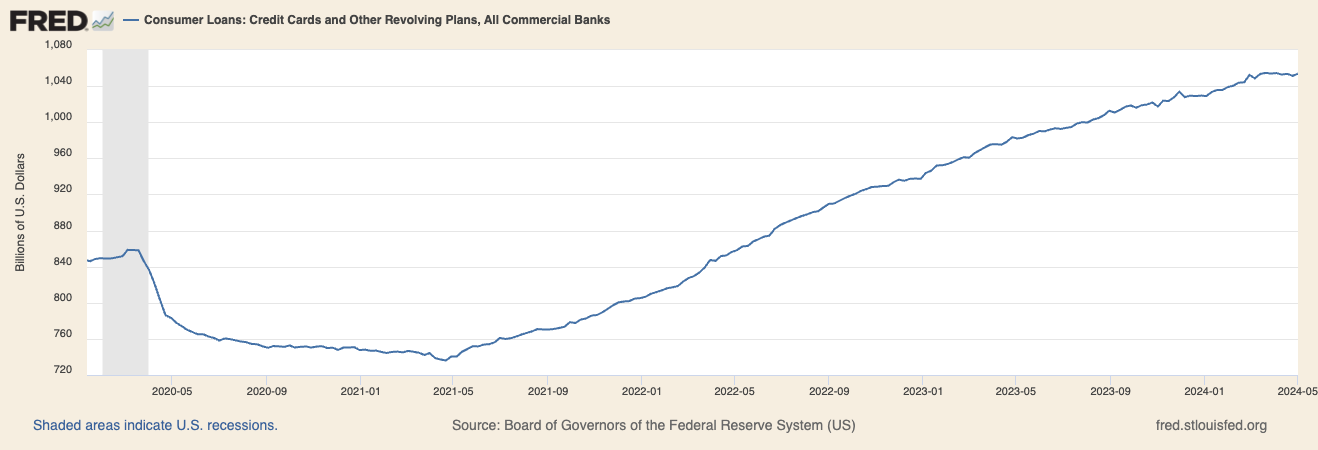

The research firm notes that while consumer borrowing was remarkably stable in the years leading up to the pandemic, growth surged to levels not seen since the pre-financial crisis era following the initial pandemic shock. However, this surge has reversed sharply since the beginning of 2022.

"Growth in borrowing briefly weakened when the pandemic was at its worst but swiftly and powerfully rebounded to a pace not seen since the years leading up to the financial crisis," reports Moody's Analytics. "Growth peaked around the start of 2022 and has since fallen rapidly."

Several demand-side factors are contributing to the slowdown. High interest rates, which are expected to remain elevated for longer than previously anticipated, are discouraging borrowing for mortgages, vehicles, and other big-ticket items. The high prices for these items are further deterring consumers from taking on additional debt.

The report also highlights the impact of slowing spending growth on borrowing. While real spending growth remains solid, nominal spending growth has been trending lower since its peak in 2021, driven by declining inflation. Concerns about a potential weakening of the labor market could further dampen consumers' willingness to borrow.

In addition to these demand-side factors, the report emphasizes the often-overlooked role of tightening lending standards in constraining borrowing growth. While quantitative measures of lending standards are limited, the Federal Reserve's Senior Loan Officer Opinion Survey (SLOOS) indicates that lenders have tightened standards across various loan types, including credit cards, mortgages, and auto loans.

"The supply of debt is another drag on borrowing and one that can be overlooked because it is so difficult to measure," explains Moody's Analytics. "There is no quantitative measure of lending standards because they have so many components."

The report notes that while the tightening of lending standards appears to be easing, demand-side pressures are also expected to moderate in the coming months. Interest rates are unlikely to rise further and are projected to decline by year-end, while declines in nominal spending growth should be modest.

"Over time, declines in consumer borrowing growth should moderate and end," concludes Moody's Analytics.