US Consumers Tightening Their Belts as Economic Headwinds Mount, Moody's Analytics Reports

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

American consumers, the driving force behind recent US economic growth, are adopting a more cautious approach to spending as various economic headwinds gather strength, according to a report by Moody's Analytics published last week.

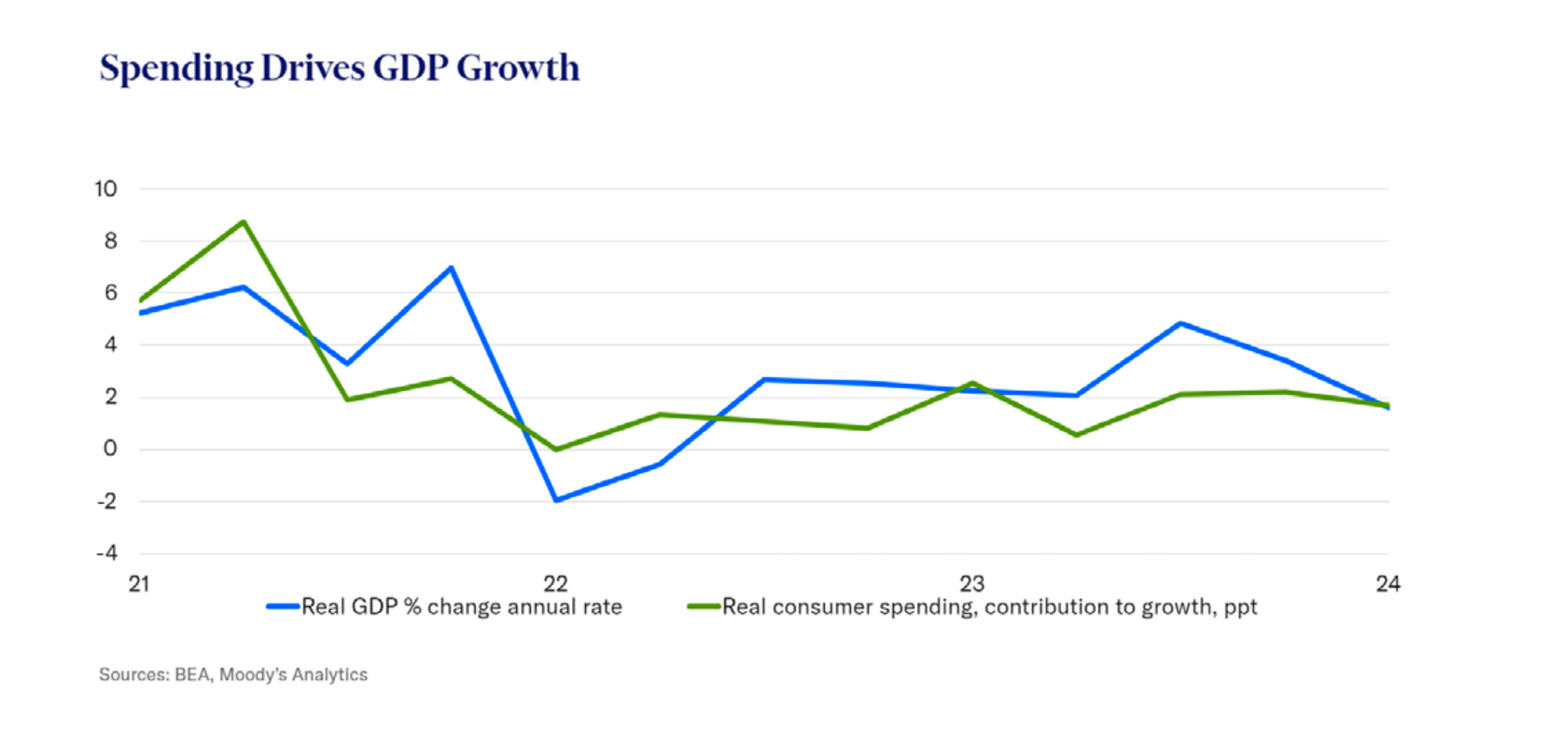

While consumer spending has single-handedly fueled GDP growth for the past three quarters, contributing nearly two percentage points each period, analysts warn that this trend is unsustainable and expect a slowdown in the months ahead.

"The trend in consumer spending growth will be downward, though not to the point where spending contracts," says Scott Hoyt, Senior Director at Moody's Analytics.

Several factors are contributing to this more cautious consumer outlook. Job growth is slowing, leading indicators suggest a moderation in wage gains, and rising interest rates are making borrowing more expensive and difficult. While historically low debt burdens provide some leeway for consumers to take on more debt, the surge in interest rates will likely lead to higher debt payments as low-rate loans taken out during the pandemic roll over.

Adding to the uncertainty is the recent decline in the saving rate. While this partly reflects consumers tapping into excess savings accumulated during the pandemic, it raises concerns about the sustainability of this trend. Further, inflated asset prices, particularly in housing and the stock market, add to the fragility of the current economic landscape.

“Homes are overvalued, and house price appreciation is unlikely to maintain its recent pace," the report notes. "The stock market has been trending lower recently, but with interest rates remaining high, it can be argued that it too remains overvalued."

Despite these headwinds, some positive factors remain. Inflation has decelerated and is expected to fall further, and the Federal Reserve is anticipated to begin cutting interest rates later this year. However, consumer confidence remains subdued, weighed down by perceptions of high prices, rising interest rates, and a weakening labor market.

Moody’s Analytics emphasizes that risks to the outlook remain substantial and skewed to the downside. Geopolitical instability, potential financial system shocks, and the possibility of a contested election all threaten to further dampen consumer sentiment and spending. The report underscores the importance of monitoring these developments closely as the US economy navigates a challenging and uncertain period.