US Labor Market Braces for Mid-Cycle Slowdown

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

The US labor market is poised to enter a slowdown in the coming months, according to an analysis published by Goldman Sachs last week. The bank cites declining temp penetration, a leading indicator of broader labor market trends, as evidence of the impending slowdown.

"With increasing instances of hiring freezes and corporate downsizing, we expect demand for labor to soften and the supply of labor to increase," Goldman Sachs analysts write.

Temp staffing typically anticipates macro and labor market trends by two to four quarters, and the recent decline in temp penetration suggests that the US labor market is entering its mid-to-late cyclical stages. Temp penetration fell to 1.74% in March from 1.75% in February, continuing a downward trend that began in March 2022.

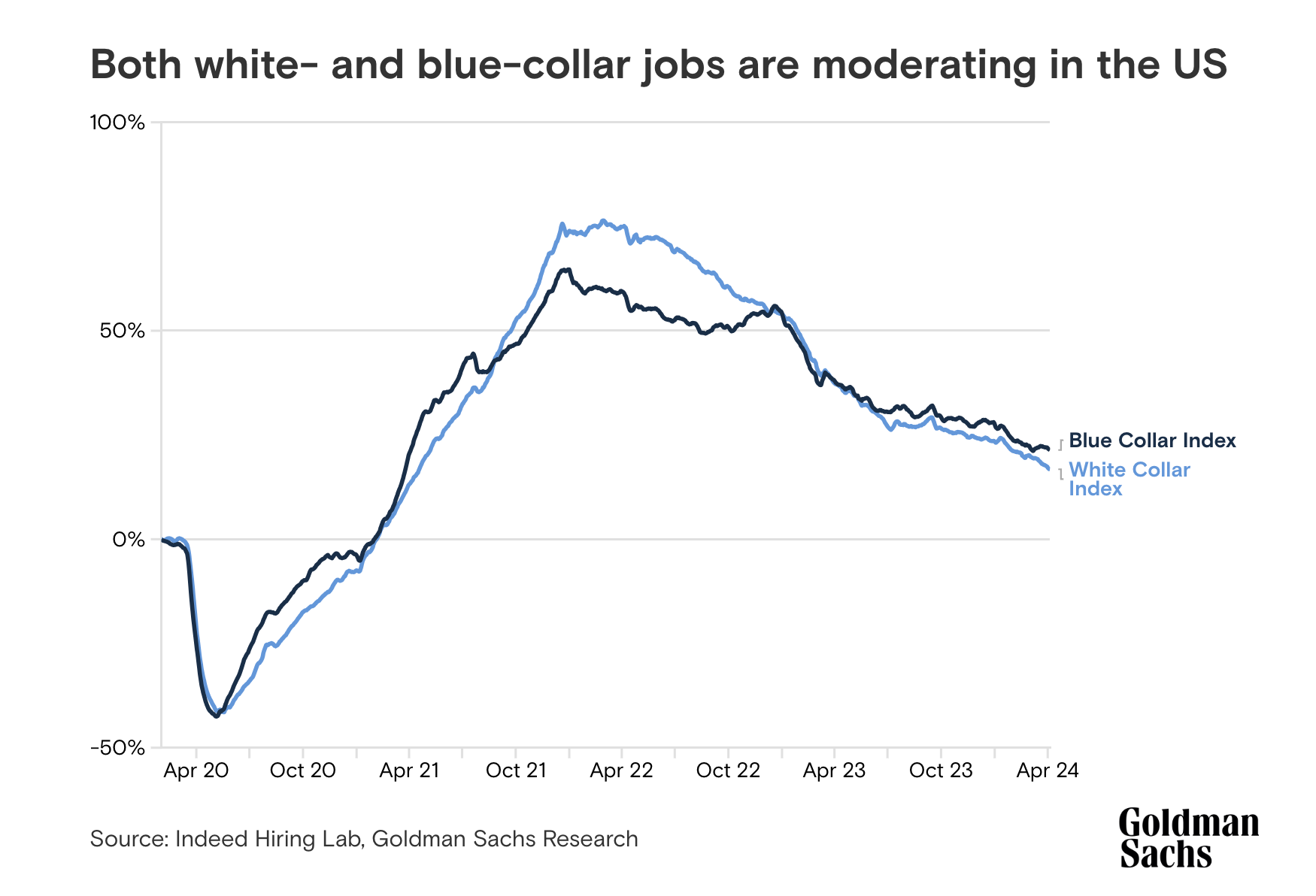

Goldman Sachs analysts also note that job posting volumes have pulled back the most in blue-collar and clerical verticals such as construction, manufacturing, and retail, while white-collar and highly skilled verticals have shown some stability but remain below pre-pandemic levels.

Since the start of the year, job postings as a percentage of pre-Covid levels have declined 18 percentage points in construction, 15 percentage points in manufacturing, and 12 percentage points in retail. The number of job openings also declined 11% year-on-year in February 2024.

"Based on this mosaic, we conclude that the US labor market in its mid-to-late cyclical stages that will see unemployment rise and non-farm employment decline over the next four quarters," Goldman Sachs Research writes.