US Tariffs Harmed, Not Helped, American Firms: New York Fed

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

A recent study by the Federal Reserve Bank of New York reveals that tariffs imposed during the 2018-2019 U.S.-China trade war largely harmed, rather than protected, American companies. The analysis, published in the bank’s “Liberty Street Economics” blog, found widespread losses across publicly listed U.S. firms following major tariff announcements, with negative impacts extending beyond stock market fluctuations to real-world performance.

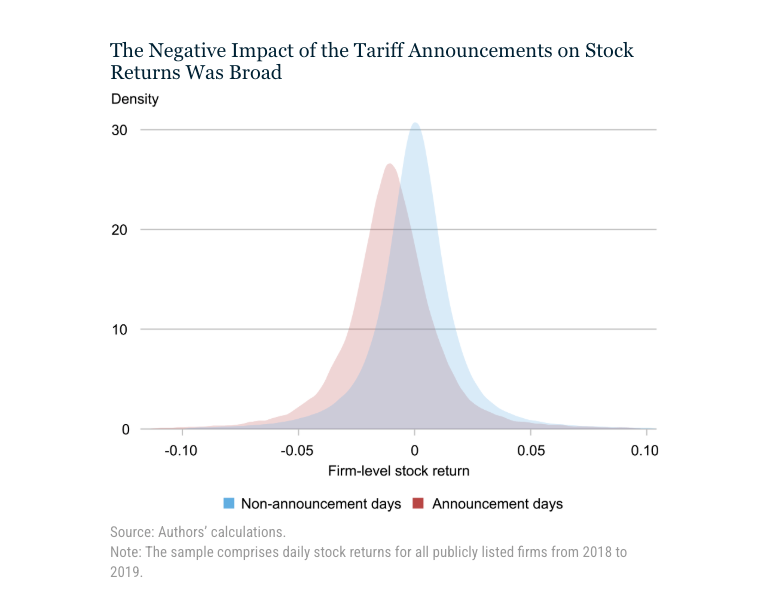

The study, authored by Mary Amiti, head of Labor and Product Market Studies at the New York Fed, and economists from Columbia University, examined stock market responses to tariff announcements during the trade war. The results showed a clear shift to the left in the distribution of stock returns for publicly listed firms on days when tariffs were announced, indicating a broad negative impact on share values.

“The expectation is that tariffs protect domestic firms by making imported goods more expensive,” explained Amiti. “However, our findings suggest that in practice, many U.S. firms suffered significant losses.”

A key reason for this, the study found, is that U.S. tariffs targeted not only finished goods but also crucial inputs like steel. By raising the cost of production for American manufacturers, these input tariffs made domestic goods less competitive compared to foreign-produced goods. Furthermore, retaliatory tariffs imposed by China on U.S. exports further hampered the performance of American companies.

Firms that had a direct exposure to China – either through importing from China or selling in China – experienced the largest losses in the stock market on tariff announcement days. However, even companies that were not directly exposed to China saw negative impacts, indicating the widespread effects of the trade war policies.

The research also demonstrated a strong correlation between stock price movements on tariff-announcement days and future firm performance. Companies that saw the largest drops in stock value during the trade war went on to experience significant decreases in profits, employment, sales, and even labor productivity between 2019 and 2021. Specifically, a 0.56 percent fall in a firm's market value on these days was linked to a staggering 12.9 percent drop in profits, 3.9 percent drop in employment, a 6.7 percent drop in sales, and a 2.2 percent drop in productivity.

“This research demonstrates that navigating tariffs is difficult, especially with global supply chains being so complex,” said study co-author Matthieu Gomez, a professor at Columbia University. “Furthermore, foreign countries often retaliate against tariffs, which further compounds the problem.”

The authors concluded that the data shows American companies experienced broad and significant losses as a result of the tariffs, underscoring the complexities of trade policy and raising serious questions about the effectiveness of tariffs as a tool to protect domestic industry. This work adds to the growing body of literature that reveals the often unintended and negative consequences of trade protectionism.