Oil Price Outlook: Upside Risks Dominate, Says World Bank

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

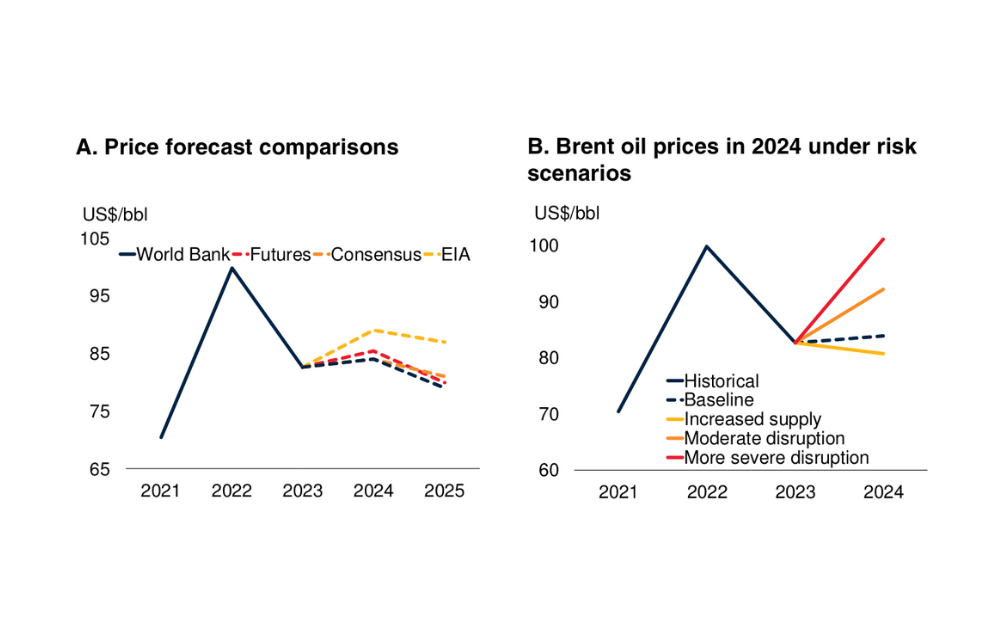

Despite a moderate price increase projected for 2024, the World Bank's latest report on the global crude oil market warns of significant upside risks that could send prices soaring. Escalating geopolitical tensions, particularly in the Middle East, and potential disruptions to North American oil production are identified as key factors that could disrupt the market and lead to a steeper price climb than initially anticipated.

Surge in Prices Driven by Geopolitical Tensions and Supply Management

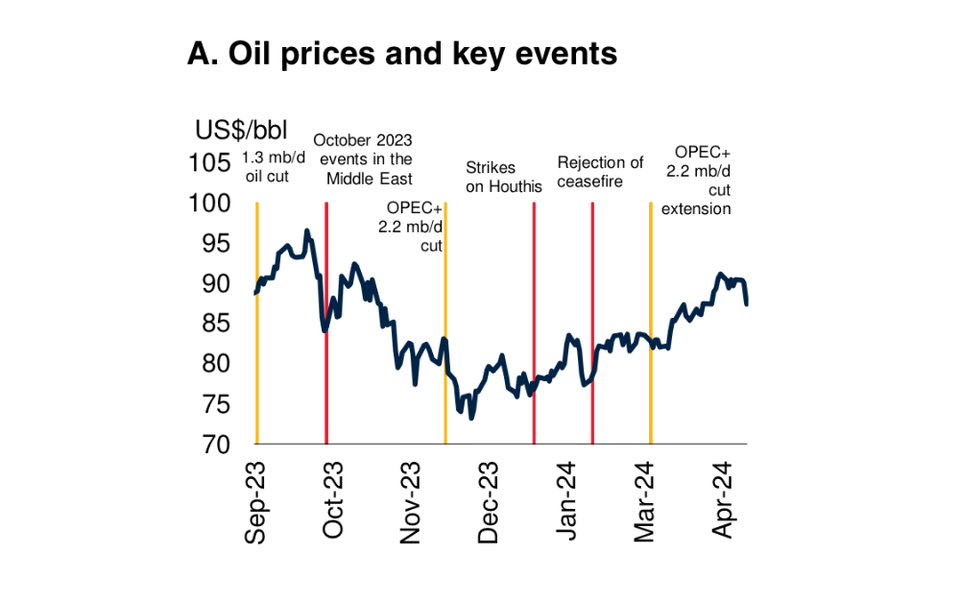

Recent geopolitical tensions and supply management measures have propelled crude oil prices to new highs, with Brent crude surpassing $90 per barrel for the first time in six months. Declining US inventories, coupled with a shift in the International Energy Agency's projection from an oil surplus to a slight deficit, have fueled bullish sentiment. Adding to the mix, geopolitical tensions in the Middle East and disruptions in Russia's refinery sector have raised concerns about potential supply disruptions.

Potential Impact of Middle East Conflict on Oil Prices

"The possibility of a broader conflict in the Middle East continues to represent a crucial risk to oil prices, and is likely to set the tone for near-term movements in oil prices," says the World Bank

The report outlines three potential scenarios for oil prices depending on the severity of conflict in the Middle East. The baseline scenario assumes no significant escalation, with Brent crude averaging $84 per barrel in 2024. However, a moderate conflict disrupting 1 million barrels per day of oil supply could push prices up to $92 per barrel, a 10% increase. In a more severe conflict scenario, with disruptions reaching 3 million barrels per day, oil prices could soar to an average of $102 per barrel, potentially stalling global disinflation efforts.

Uncertainties Surrounding North American Production

Meanwhile, concerns about the ability of US shale oil firms to meet production targets are mounting due to rising industry input costs, stagnating production, and a decline in active wells. While the World Bank's baseline forecast assumes US oil production will grow by 0.6 million barrels per day in 2024, a shortfall in US production could exacerbate the existing supply constraints and further elevate prices.

Demand Dynamics and Potential for Earlier OPEC+ Production Increase

Global oil demand growth has softened in recent months, with China accounting for a significant portion of the overall increase. However, demand in advanced economies has stagnated, and the post-pandemic rebound in consumption appears to be losing momentum. This, coupled with the increasing adoption of electric vehicles, suggests that global oil consumption may be nearing its peak.

The report acknowledges the possibility of an earlier-than-expected reversal of OPEC+ production cuts as a downside risk. This could occur due to concerns over Saudi Arabia's fiscal deficit and potential loss of market share to other producers. However, the report also notes that Saudi Arabia's debt-to-GDP ratio remains manageable, and OPEC+ still holds a substantial share of global oil supply.

Weaker Global Growth Poses a Downside Risk

Another potential factor impacting oil prices is the risk of weaker-than-expected global economic growth, potentially stemming from financial stress, persistent inflation, or a further weakening of China's economy. Tighter monetary policies or a decline in Chinese consumer confidence could dampen oil demand and lead to lower prices.

As of the date of this article, Brent crude is trading at $87 per barrel, up from $75 in the beginning of the year.