Japan's Stock Market Rally Shows Staying Power: Fidelity

Sign up for Global Macro Playbook: Stay ahead of the curve on global macro trends.

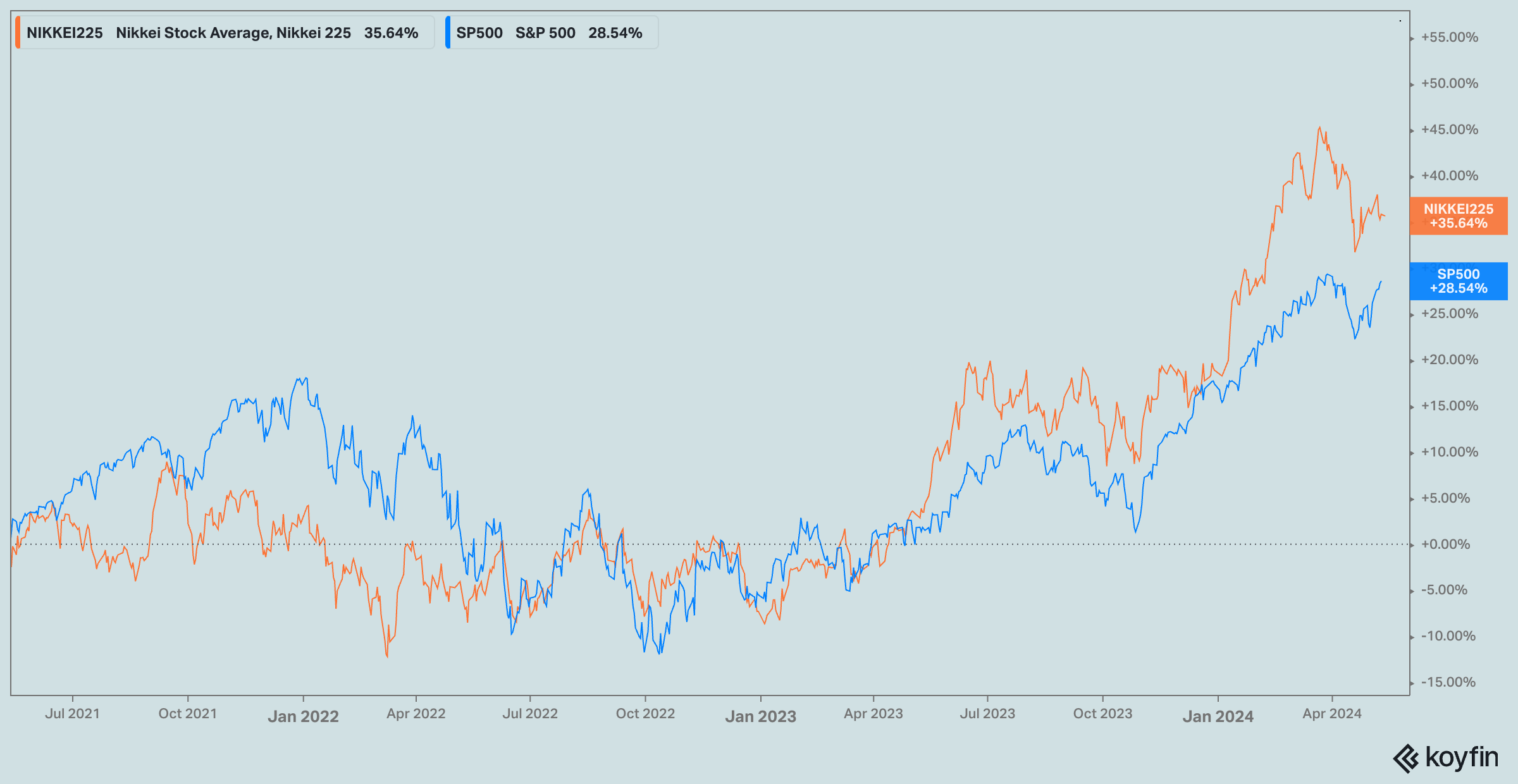

Japan's stock market continues its upward trajectory in 2024, building on its bull run in 2023. According to a report published by Fidelity on Friday, the rally is driven by a combination of technical factors, improving economic fundamentals, and ongoing corporate governance reforms. However, sustained gains will likely depend on continued price and wage increases, solidifying Japan's departure from decades of deflation.

From Technical Strength to Increased Investor Interest

Japan's Nikkei 225 index reached a record high in February, surpassing 30,000, driven by monetary policy normalization and corporate governance reforms. The Tokyo Stock Exchange's mandate for companies trading below book value to improve their performance has spurred stock buybacks and prompted companies to focus on enhancing shareholder value.

Chart 1: Nikkei 225 vs S&P500 (3-year return)

This positive momentum has attracted increased attention from professional investors globally, with a growing focus on identifying investment opportunities in Japan. Fidelity notes a surge in interest from its research teams and portfolio managers, who have been actively engaging with Japanese companies, policymakers, and analysts.

Labor Market Improvements Drive Inflationary Shift

A key driver of Japan's economic turnaround is the transition to mild inflation after decades of stagnant growth and deflation. The country's improving labor market, characterized by nominal wage increases and higher labor turnover, is playing a pivotal role in this shift.

"Japan’s labor market has seen very little inflation for decades," acknowledges the Fidelity report. "That said, we’re seeing anecdotal evidence of nominal wage inflation, helping to support an improved employment picture. In some industries, the increases have been substantial."

The report highlights a shift away from Japan's traditional lifetime employment model, with younger workers increasingly seeking new opportunities and driving up wages in certain industries. This increased labor mobility is expected to contribute to higher productivity and support economic growth.

Consumer Spending and Future Growth Prospects

Higher wages have empowered Japanese consumers to accept price increases across a range of goods and services, marking a significant departure from the deflationary mindset that has long prevailed in the country. This shift in consumer behavior is crucial for sustaining economic growth, as domestic consumption accounts for over half of Japan's GDP.

Read More: The Resurgence of Japan

Fidelity also identifies several emerging trends that could further bolster Japan's economic prospects, including corporate investments in labor-saving technologies, advancements in renewable energy, a more favorable stance toward immigration, and a weaker yen, which benefits exporters.

Corporate Governance Reforms Remain Key

The report emphasizes that corporate governance improvements in Japan are still in their early stages but are gaining momentum. Pressure from the Tokyo Stock Exchange, the government, activist shareholders, and industry peers is driving companies to focus on maximizing returns and enhancing shareholder value.

"We believe corporate governance improvements in Japan are still in early stages," notes Fidelity. "The pressure to eke out more returns from existing company assets appears to be intensifying."

Navigating Potential Risks

Despite the positive trends, several risks could derail Japan's economic momentum. Uncertainty surrounding the Bank of Japan's ability to navigate a shift from quantitative easing to tighter monetary policy without stifling growth remains a key concern. Additionally, the ongoing sluggish recovery in China poses risks to the cyclical side of the Japanese economy, given its reliance on Chinese demand.

The report also highlights potential risks stemming from US elections and rising stock valuations. A second Trump administration could lead to increased trade tensions with China, negatively impacting Japanese exports and regional economic growth. The recent rally in Japanese stocks has also led to higher valuations, requiring investors to be more selective in identifying opportunities with strong fundamentals and potential for further growth.

"There’s also risk to the cyclical side of the Japanese economy, given the ongoing sluggish recovery in China," warns Fidelity. "Investors in Japan must also monitor U.S. elections."